Question: Tim participates in a defined contribution pension plan ( DCPP ) offered by his employer. The plan requires that both the employer and employee each

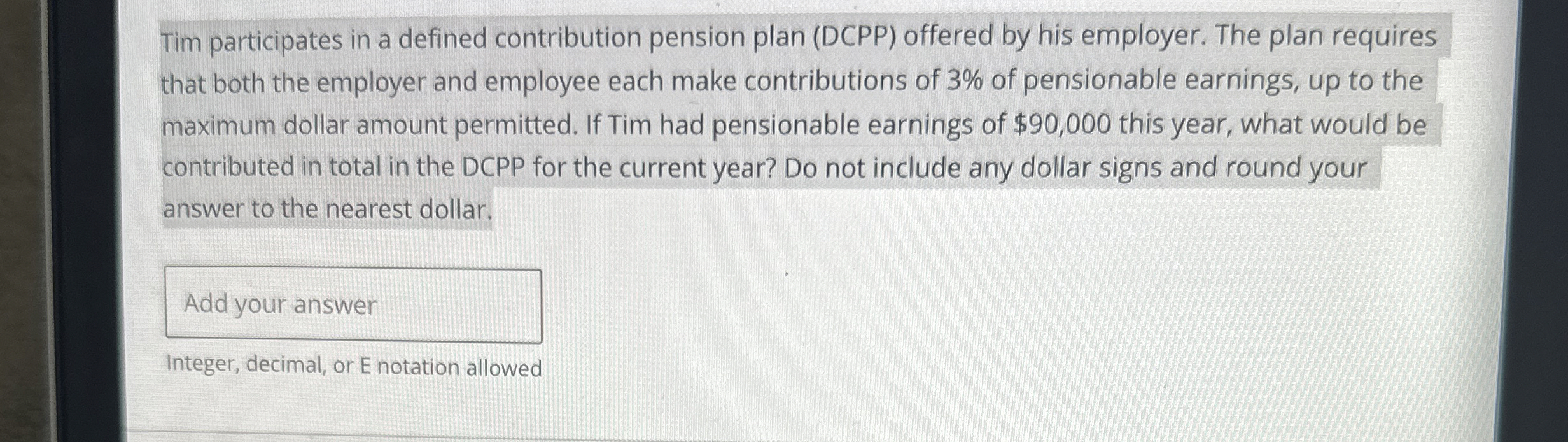

Tim participates in a defined contribution pension plan DCPP offered by his employer. The plan requires that both the employer and employee each make contributions of of pensionable earnings, up to the maximum dollar amount permitted. If Tim had pensionable earnings of $ this year, what would be contributed in total in the DCPP for the current year? Do not include any dollar signs and round your answer to the nearest dollar.

Integer, decimal, or E notation allowed

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock