Question: Question 1 2 ( 1 point ) * * in Canada * * Vanessa, age 4 5 , started a new job as an administrator

Question point in Canada

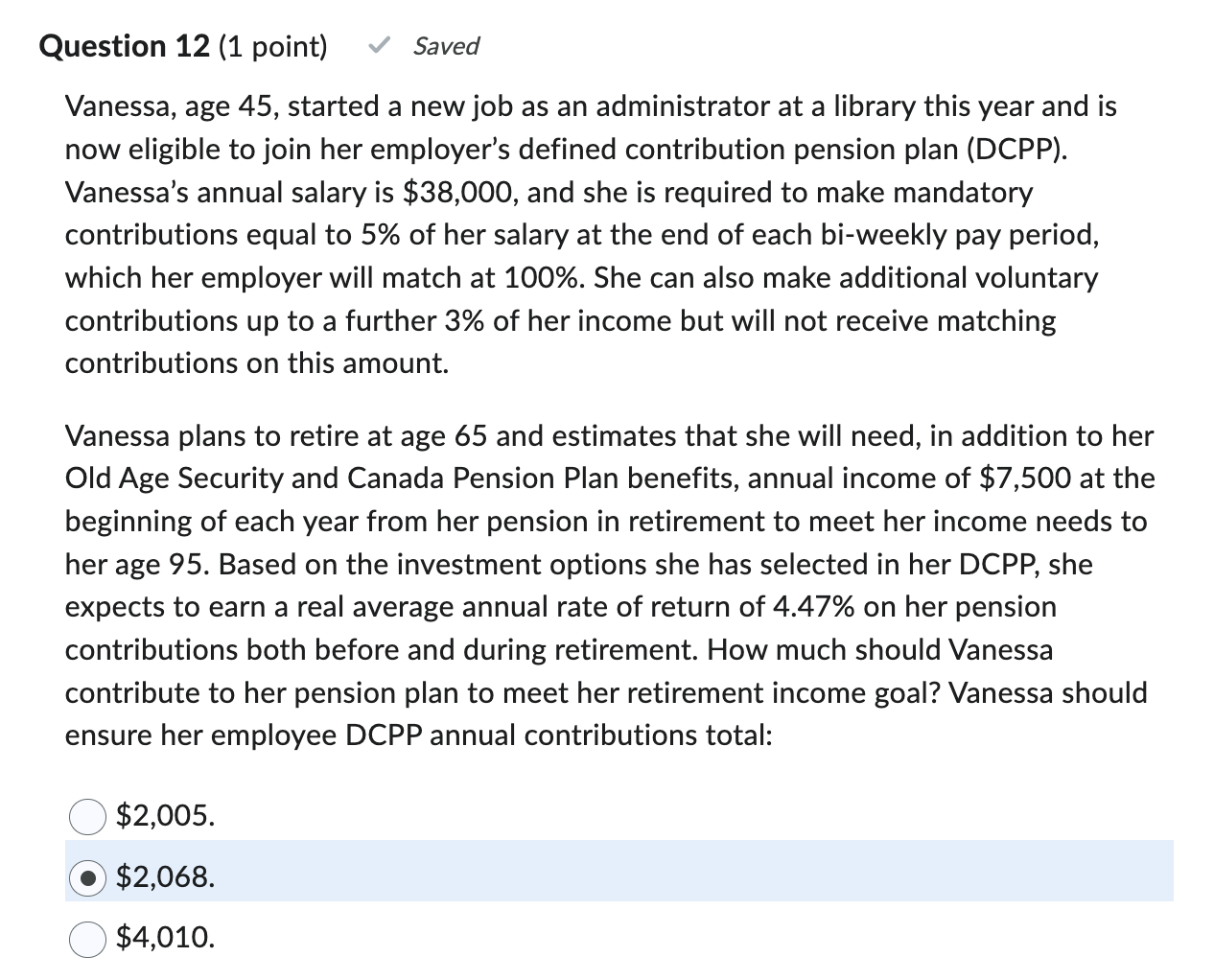

Vanessa, age started a new job as an administrator at a library this year and is

now eligible to join her employer's defined contribution pension plan DCPP

Vanessa's annual salary is $ and she is required to make mandatory

contributions equal to of her salary at the end of each biweekly pay period,

which her employer will match at She can also make additional voluntary

contributions up to a further of her income but will not receive matching

contributions on this amount.

Vanessa plans to retire at age and estimates that she will need, in addition to her

Old Age Security and Canada Pension Plan benefits, annual income of $ at the

beginning of each year from her pension in retirement to meet her income needs to

her age Based on the investment options she has selected in her DCPP she

expects to earn a real average annual rate of return of on her pension

contributions both before and during retirement. How much should Vanessa

contribute to her pension plan to meet her retirement income goal? Vanessa should

ensure her employee DCPP annual contributions total:

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock