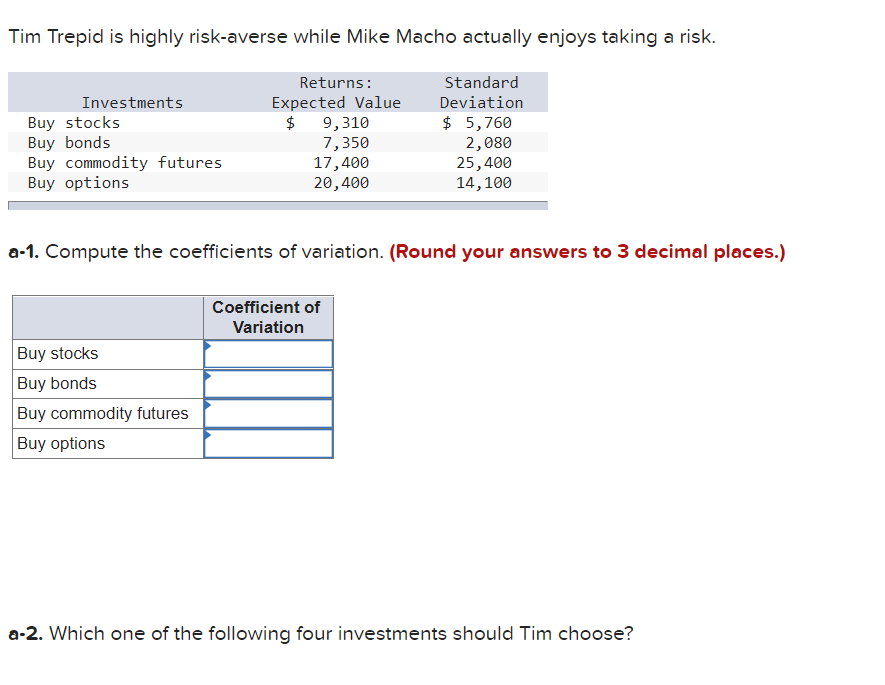

Question: Tim Trepid is highly risk-averse while Mike Macho actually enjoys taking a risk. Investments Buy stocks Buy bonds Buy commodity futures Buy options Returns: Expected

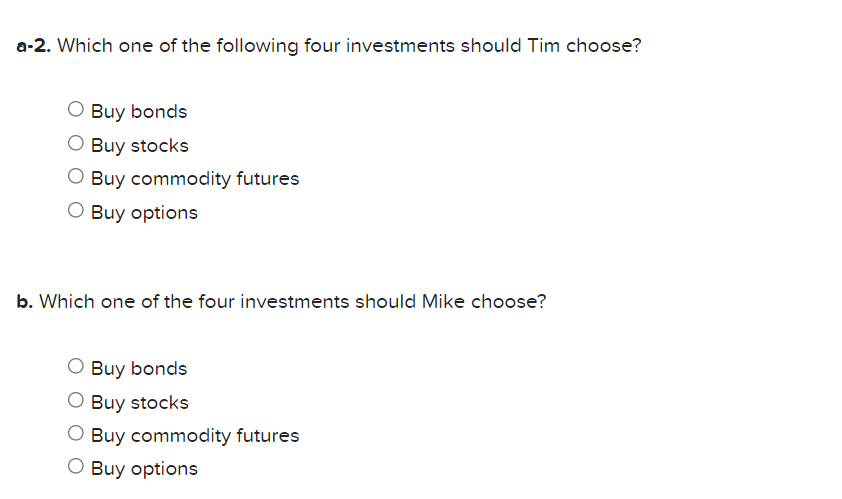

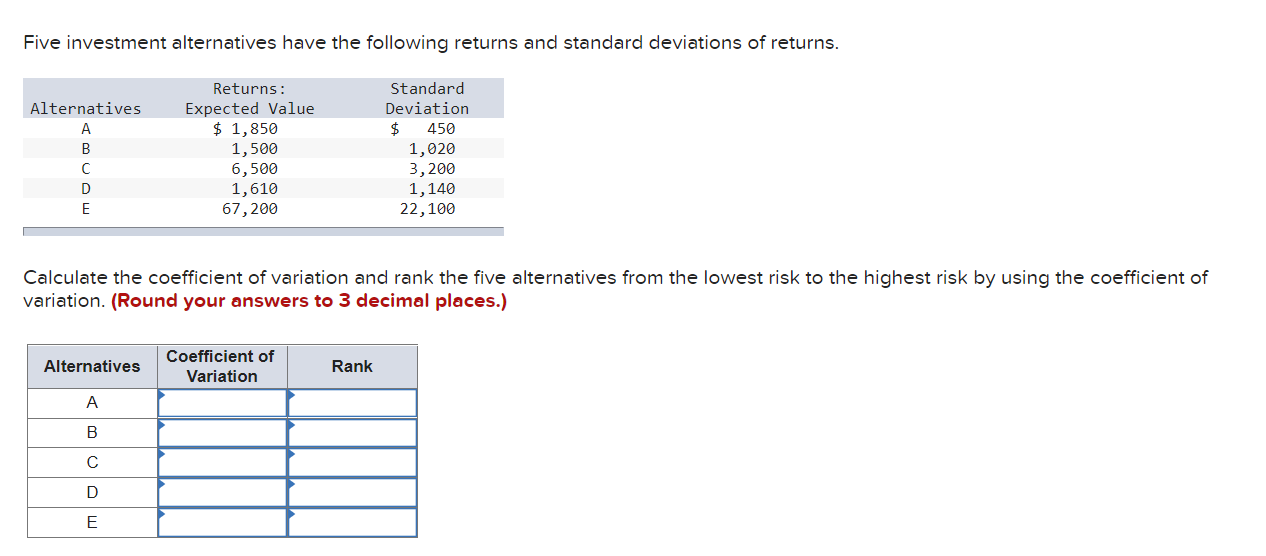

Tim Trepid is highly risk-averse while Mike Macho actually enjoys taking a risk. Investments Buy stocks Buy bonds Buy commodity futures Buy options Returns: Expected Value $ 9,310 7,350 17,400 20,400 Standard Deviation $ 5,760 2,080 25,400 14,100 a-1. Compute the coefficients of variation. (Round your answers to 3 decimal places.) Coefficient of Variation Buy stocks Buy bonds Buy commodity futures Buy options a-2. Which one of the following four investments should Tim choose? a-2. Which one of the following four investments should Tim choose? O Buy bonds O Buy stocks O Buy commodity futures O Buy options b. Which one of the four investments should Mike choose? O Buy bonds Buy stocks O Buy commodity futures O Buy options Five investment alternatives have the following returns and standard deviations of returns. Alternatives A B c Returns: Expected Value $ 1,850 1,500 6,500 1,610 67,200 Standard Deviation $ 450 1,020 3,200 1,140 22,100 D E Calculate the coefficient of variation and rank the five alternatives from the lowest risk to the highest risk by using the coefficient of variation. (Round your answers to 3 decimal places.) Alternatives Coefficient of Variation Rank B D E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts