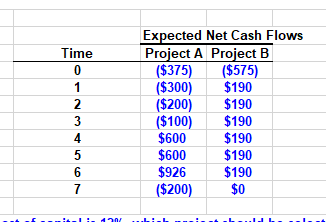

Question: Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B ($375) ($575) ($300) $190 ($200) $190 ($100) $190

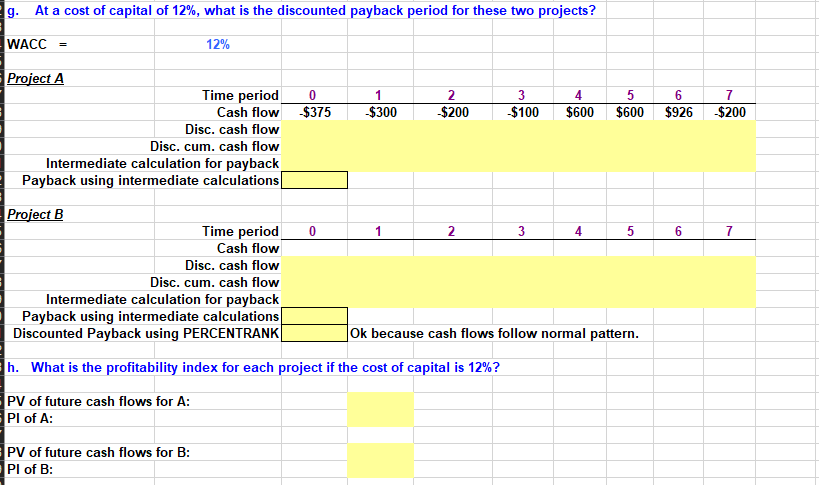

Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B ($375) ($575) ($300) $190 ($200) $190 ($100) $190 $600 $190 $600 $190 $926 $190 ($200) $0 20/ g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 0 $375 1 $300 2 $200 3 $100 4 $600 5 $600 6 $926 7 $200 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations 0 3 4 5 6 6 7 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations Discounted Payback using PERCENTRANK Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: PI of A: PV of future cash flows for B: Pl of B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts