Question: (Time allowance: 6 minutes) This is a replace now or later problem; however, the question asked is only about one part of the analysis. Do

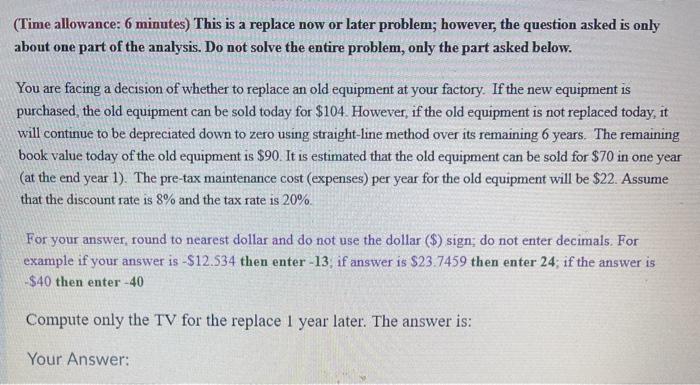

(Time allowance: 6 minutes) This is a replace now or later problem; however, the question asked is only about one part of the analysis. Do not solve the entire problem, only the part asked below. You are facing a decision of whether to replace an old equipment at your factory. If the new equipment is purchased the old equipment can be sold today for $104. However, if the old equipment is not replaced today, it will continue to be depreciated down to zero using straight-line method over its remaining 6 years. The remaining book value today of the old equipment is $90. It is estimated that the old equipment can be sold for $70 in one year (at the end year 1). The pre-tax maintenance cost expenses) per year for the old equipment will be $22. Assume that the discount rate is 8% and the tax rate is 20%. For your answer, round to nearest dollar and do not use the dollar ($) sign; do not enter decimals. For example if your answer is -$12.534 then enter -13, if answer is $23.7459 then enter 24: if the answer is -$40 then enter -40 Compute only the TV for the replace 1 year later. The answer is: Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts