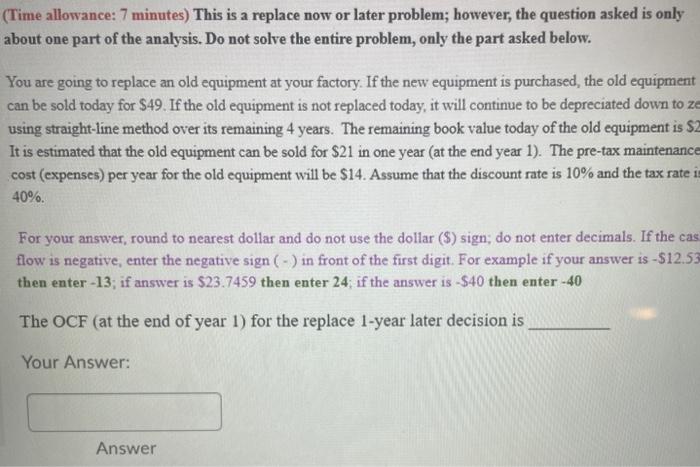

Question: (Time allowance: 7 minutes) This is a replace now or later problem; however, the question asked is only about one part of the analysis. Do

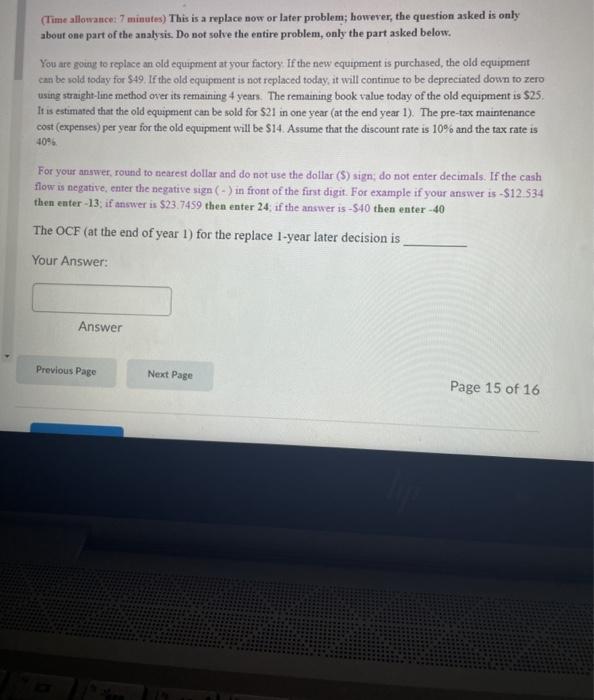

(Time allowance: 7 minutes) This is a replace now or later problem; however, the question asked is only about one part of the analysis. Do not solve the entire problem, only the part asked below. You are going to replace an old equipment at your factory. If the new equipment is purchased the old equipment can be sold today for $49. If the old equipment is not replaced today, it will continue to be depreciated down to ze using straight-line method over its remaining 4 years. The remaining book value today of the old equipment is $2 It is estimated that the old equipment can be sold for $21 in one year (at the end year 1). The pre-tax maintenance cost expenses) per year for the old equipment will be $14. Assume that the discount rate is 10% and the tax rate is 40%. For your answer, round to nearest dollar and do not use the dollar ($) sign; do not enter decimals. If the cas flow is negative, enter the negative sign ( - ) in front of the first digit. For example if your answer is -$12.53 then enter -13; if answer is $23.7459 then enter 24 if the answer is - $40 then enter -40 The OCF (at the end of year 1) for the replace 1-year later decision is Your Answer: Answer (Time allowance 7 minutes) This is a replace now or later problem; however, the question asked is only about one part of the analysis. Do not solve the entire problem, only the part asked below. You are getty to replace an old equipment at your factory. If the new equipment is purchased, the old equipment can be sold today for $49. If the old equipment is not replaced today, it will continue to be depreciated down to zero using straight-line method over its remaining 4 years. The remaining book value today of the old equipment is $25 It is estimated that the old equipment can be sold for $21 in one year (at the end year 1). The pre-tax maintenance cost (expenses) per year for the old equipment will be $14. Assume that the discount rate is 10% and the tax rate is 405 For your answer, round to nearest dollar and do not use the dollar ($) sign; do not enter decimals. If the cash flow is negative, enter the negative sign ( - ) in front of the first digit. For example if your answer is -$12.534 then enter -13; if answer is $23.7459 then enter 24, if the answer is -540 then enter -40 The OCF (at the end of year 1) for the replace 1-year later decision is Your Answer: Answer Previous Page Next Page Page 15 of 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts