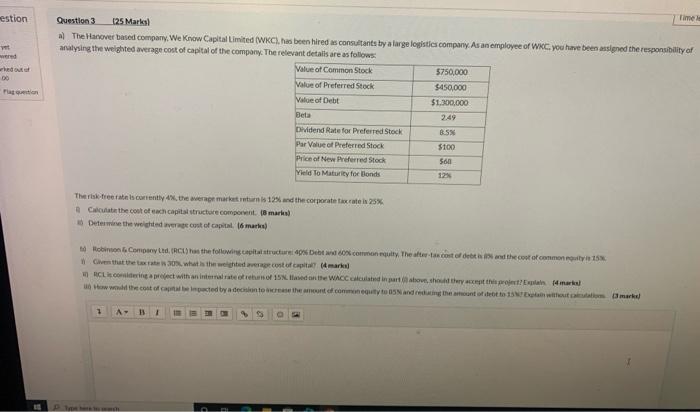

Question: Time le Question 3 (25 Marks) a) The Hanover based company. We Know Capital Limited (WKC), has been hired as consultants by a large logistics

Time le Question 3 (25 Marks) a) The Hanover based company. We Know Capital Limited (WKC), has been hired as consultants by a large logistics company. As an employee of WKC, you have been assigned the responsibility of analysing the weighted average cost of capital of the company. The relevant details are as follows: Value of Common Stock hed out of $750,000 $450,000 DO Value of Preferred Stock Value of Debt $1,300,000 Beta 2.49 8.5% Dividend Rate for Preferred Stock Par Value of Preferred Stock $100 Price of Neve Preferred Stock 560 Yield To Maturity for Bonds 12% The risk-free rate is currently 4%, the average market return is 12% and the corporate tax rate is 25% Calculate the cost of each capital structure component. (8 marks) Determine the weighted average cost of capital. (6 marks) debt is and the cost of common equity is 15% Robinson & Company Ltd. (RCL) has the following capital structure: 40% Debt and 60% common equity. The after-tax c Given that the tax rate is 30%, what is the weighted average cost of capital? (4 mark RCL is considering a project with an internal rate of return of 15%. Based on the WACC calculated in part above, should thery accept this project? Explain (4 marks How would the cost of capital be impacted by a decision to increase the amount of common equity to 05% and reducing the amount of debt to 15%? Explain without calculations (3 marks) Type herkarch PL estion yet wered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts