Question: Time left 012304 Situation Highly Material The client fails to appropriately calculate the depreciation expense during the financial year Due to the travel restrictions, the

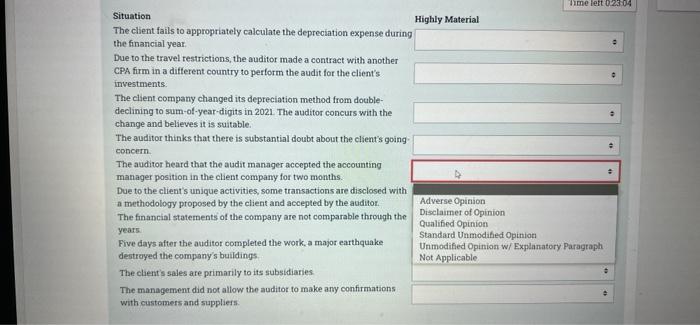

Time left 012304 Situation Highly Material The client fails to appropriately calculate the depreciation expense during the financial year Due to the travel restrictions, the auditor made a contract with another CPA firm in a different country to perform the audit for the client's investments The client company changed its depreciation method from double- declining to sum-of-year-digits in 2021. The auditor concurs with the change and believes it is suitable. The auditor thinks that there is substantial doubt about the client's going concern The auditor heard that the audit manager accepted the accounting manager position in the client company for two months. Due to the client's unique activities, some transactions are disclosed with Adverse Opinion a methodology proposed by the client and accepted by the auditor. Disclaimer of Opinion The financial statements of the company are not comparable through the Qualified Opinion years Standard Unmodified Opinion Five days after the auditor completed the work, a major earthquake Un modified Opinion w/ Explanatory Paragraph destroyed the company's buildings Not Applicable The client's sales are primarily to its subsidiaries The management did not allow the auditor to make any confirmations with customers and suppliers +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts