Question: Time left 1814:48 Question 1 A bond has a Macaulay duration of 3.78 years. What will be the percentage change in the bond price if

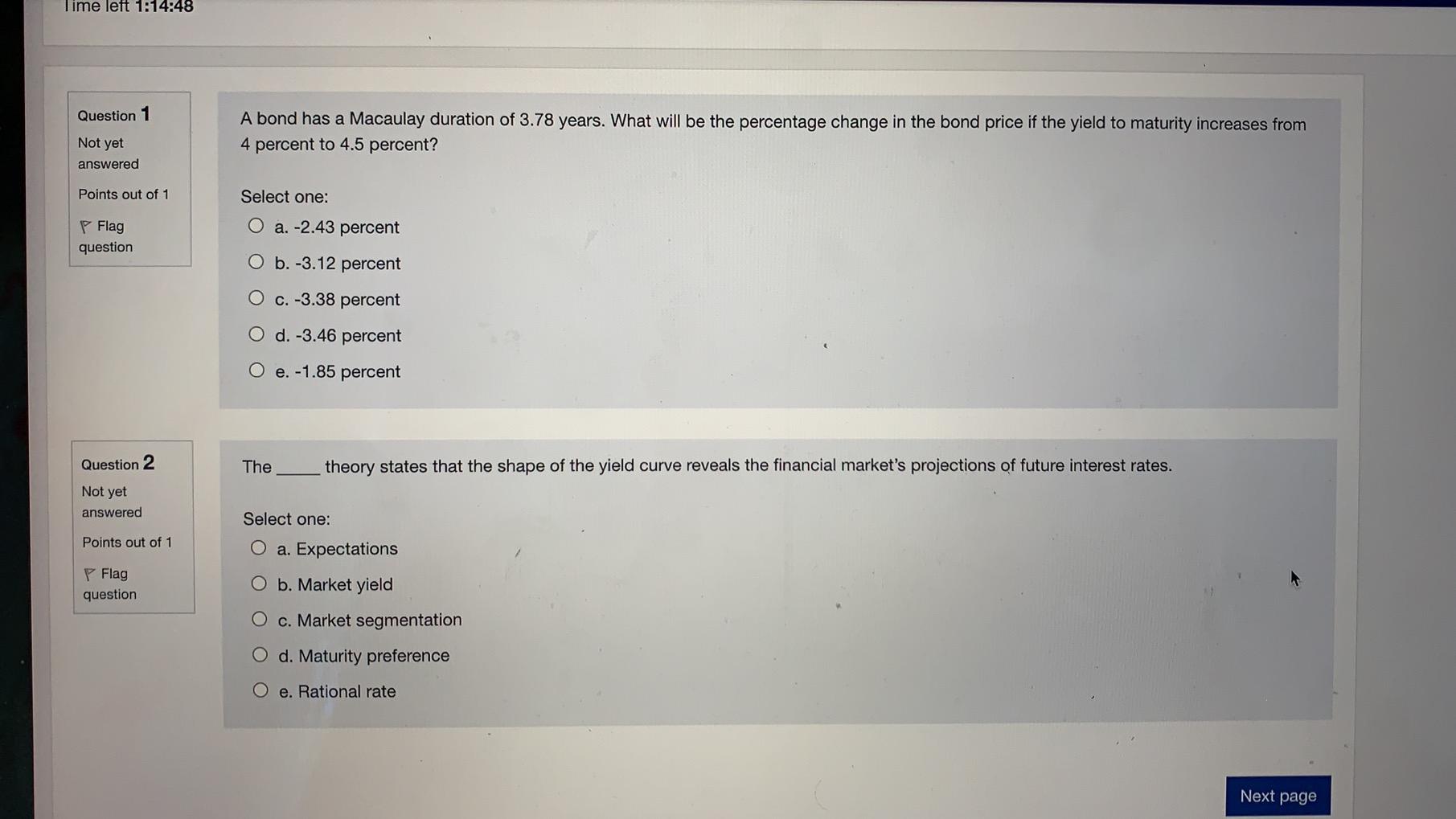

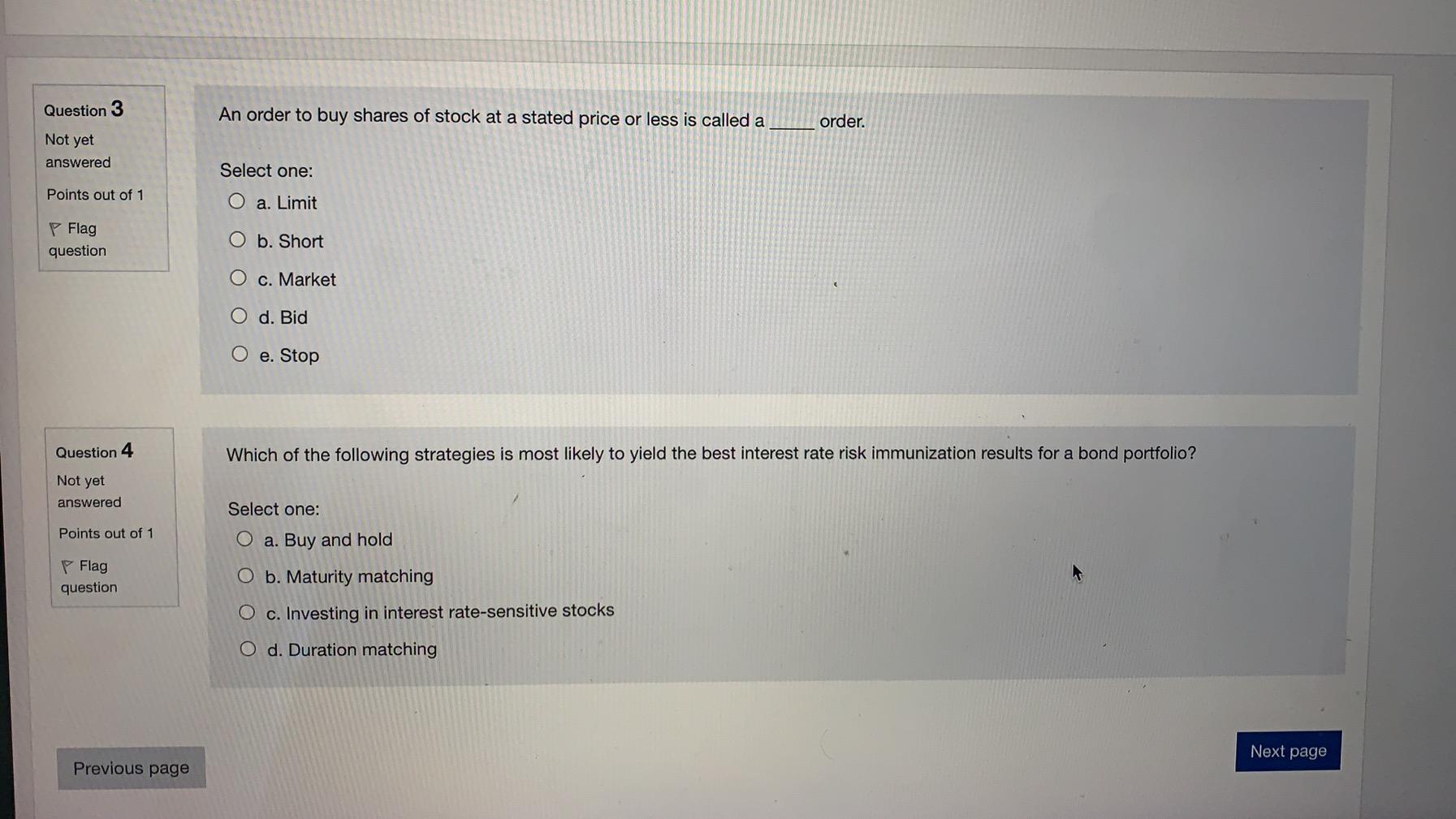

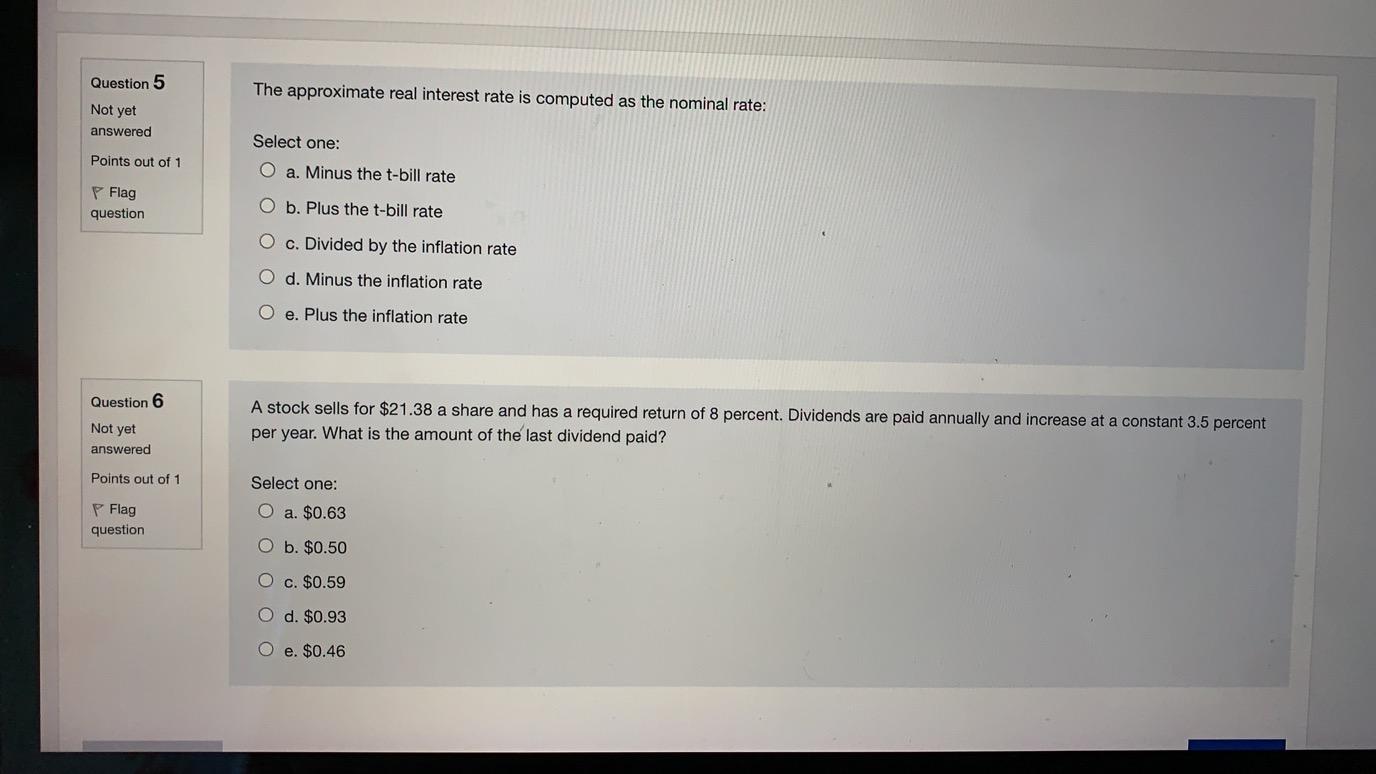

Time left 1814:48 Question 1 A bond has a Macaulay duration of 3.78 years. What will be the percentage change in the bond price if the yield to maturity increases from 4 percent to 4.5 percent? Not yet answered Points out of 1 Select one: O a.-2.43 percent Flag question O b.-3.12 percent O c.-3.38 percent O d.-3.46 percent O e. -1.85 percent Question 2 The theory states that the shape of the yield curve reveals the financial market's projections of future interest rates. Not yet answered Select one: Points out of 1 O a. Expectations Flag question O b. Market yield O c. Market segmentation d. Maturity preference O e. Rational rate Next page Question 3 An order to buy shares of stock at a stated price or less is called a order. Not yet answered Select one: Points out of 1 O a. Limit Flag question O b. Short O c. Market O d. Bid O e. Stop Question 4 Which of the following strategies is most likely to yield the best interest rate risk immunization results for a bond portfolio? Not yet answered Select one: Points out of 1 O a. Buy and hold Flag question O b. Maturity matching O c. Investing in interest rate-sensitive stocks O d. Duration matching Next page Previous page Question 5 The approximate real interest rate is computed as the nominal rate: Not yet answered Select one: Points out of 1 O a. Minus the t-bill rate P Flag question O b. Plus the t-bill rate O c. Divided by the inflation rate O d. Minus the inflation rate O e. Plus the inflation rate Question 6 A stock sells for $21.38 a share and has a required return of 8 percent. Dividends are paid annually and increase at a constant 3.5 percent per year. What is the amount of the last dividend paid? Not yet answered Points out of 1 Select one: O a. $0.63 P Flag question O b. $0.50 O c. $0.59 O d. $0.93 O e. $0.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts