Question: Question 1 (1 point) When a house is purchased, there are several extra costs to pay. These costs are usually given as a percent of

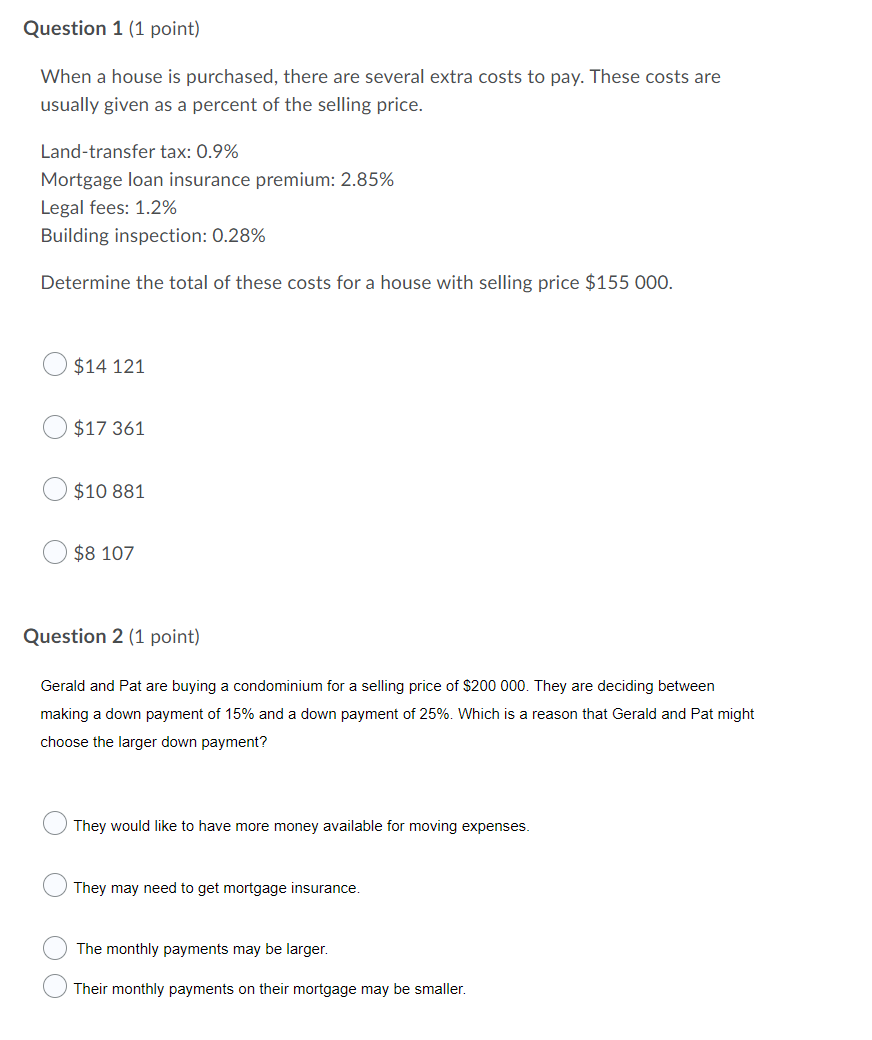

Question 1 (1 point) When a house is purchased, there are several extra costs to pay. These costs are usually given as a percent of the selling price. Land-transfer tax: 0.9% Mortgage loan insurance premium: 2.85% Legal fees: 1.2% Building inspection: 0.28% Determine the total of these costs for a house with selling price $155 000. $14 121 $17 361 $10 881 $8 107 Question 2 (1 point) Gerald and Pat are buying a condominium for a selling price of $200 000. They are deciding between making a down payment of 15% and a down payment of 25%. Which is a reason that Gerald and Pat might choose the larger down payment? O They would like to have more money available for moving expenses. O They may need to get mortgage insurance. The monthly payments may be larger. Their monthly payments on their mortgage may be smaller

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts