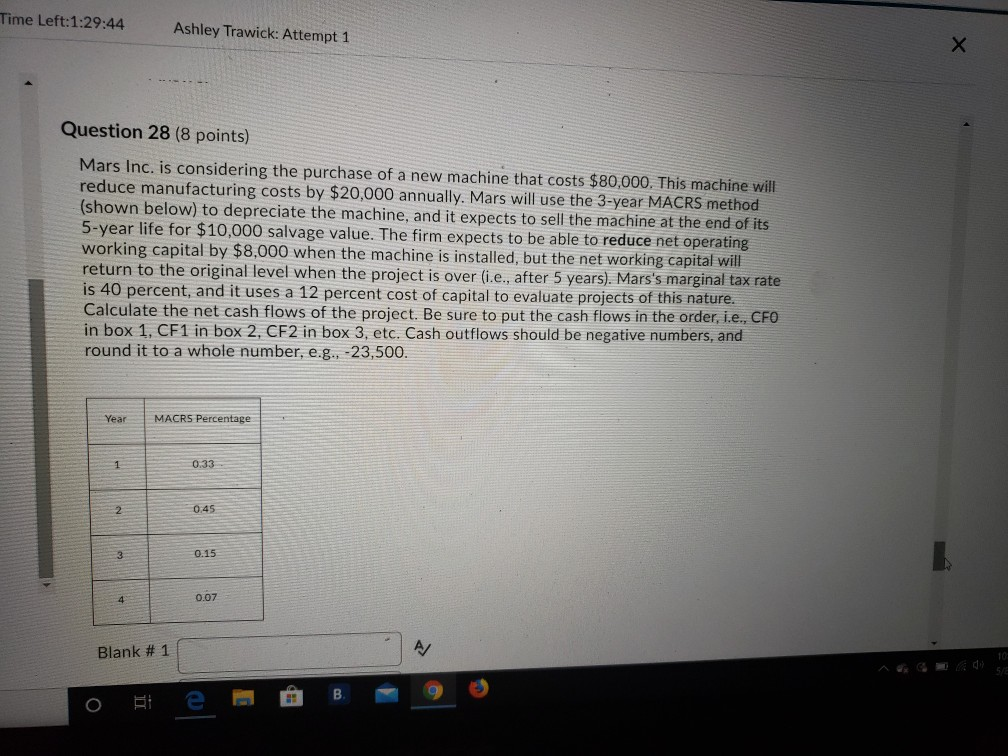

Question: Time Left:1:29:44 Ashley Trawick: Attempt 1 Question 28 (8 points) Mars Inc. is considering the purchase of a new machine that costs $80,000. This machine

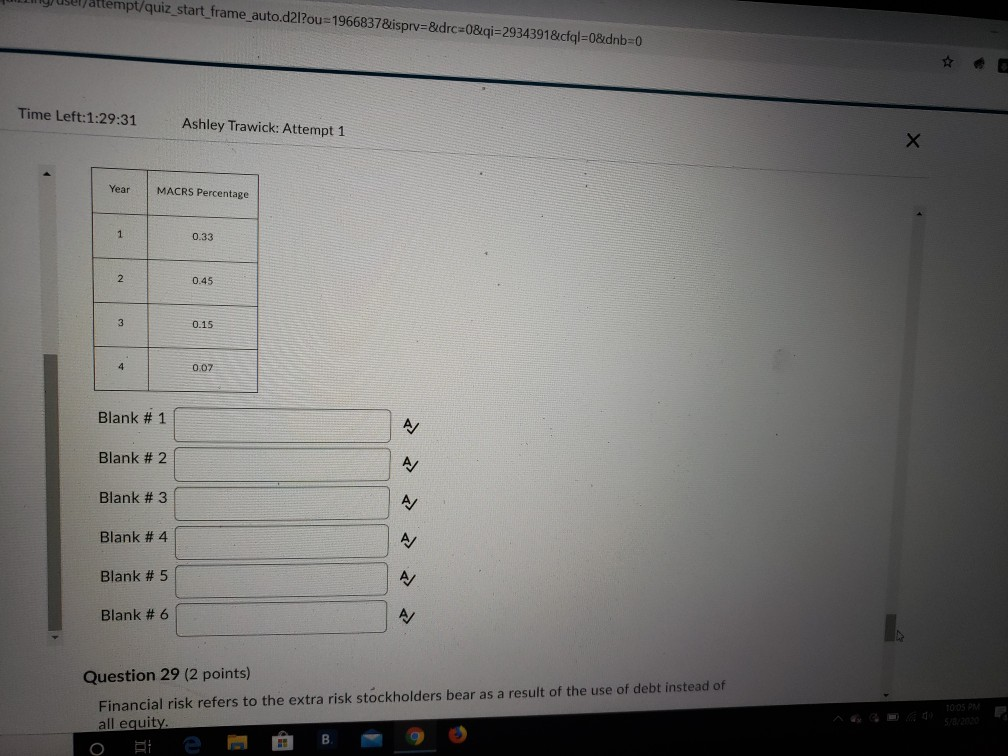

Time Left:1:29:44 Ashley Trawick: Attempt 1 Question 28 (8 points) Mars Inc. is considering the purchase of a new machine that costs $80,000. This machine will reduce manufacturing costs by $20,000 annually. Mars will use the 3-year MACRS method (shown below) to depreciate the machine, and it expects to sell the machine at the end of its 5-year life for $10,000 salvage value. The firm expects to be able to reduce net operating working capital by $8,000 when the machine is installed, but the net working capital will return to the original level when the project is over (i.e., after 5 years). Mars's marginal tax rate is 40 percent, and it uses a 12 percent cost of capital to evaluate projects of this nature. Calculate the net cash flows of the project. Be sure to put the cash flows in the order, i.e., CFO in box 1, CF1 in box 2, CF2 in box 3, etc. Cash outflows should be negative numbers, and round it to a whole number, e.g.. -23,500. Year MACRS Percentage 0.33 0.45 0.15 0.07 + Blank # 1 o Bie @ B- M enyusel attempt/quiz_start_frame_auto.d2l?ou=1966837&ispry=&drc=08.qi=2934391&cfql=0&dnb=0 Time Left:1:29:31 Ashley Trawick: Attempt 1 Year MACRS Percentage 0.33 N 0.45 W 0.15 0.07 Blank # 1 Blank # 2 Blank # 3 Blank # 4 Blank # 5 Blank # 6 Question 29 (2 points) Financial risk refers to the extra risk stockholders bear as a result of the use of debt instead of all equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts