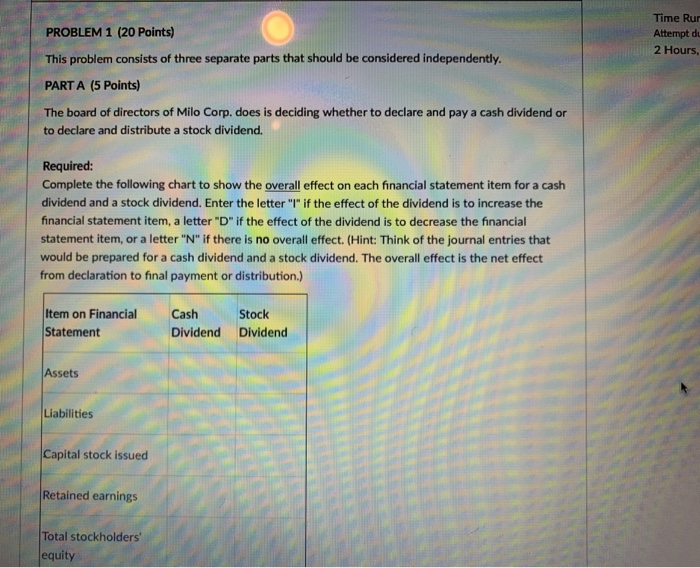

Question: Time Rur Attempt d 2 Hours PROBLEM 1 (20 Points) This problem consists of three separate parts that should be considered independently. PART A (5

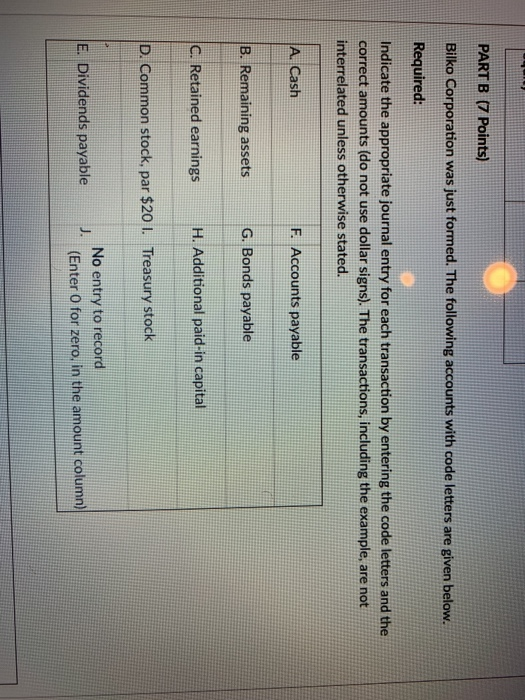

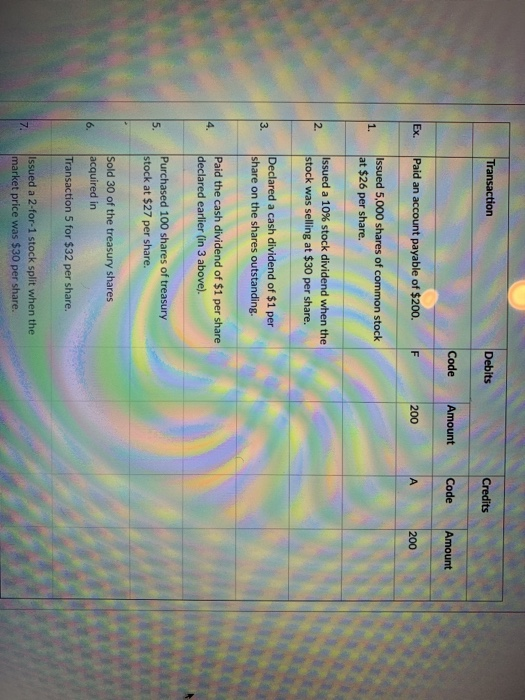

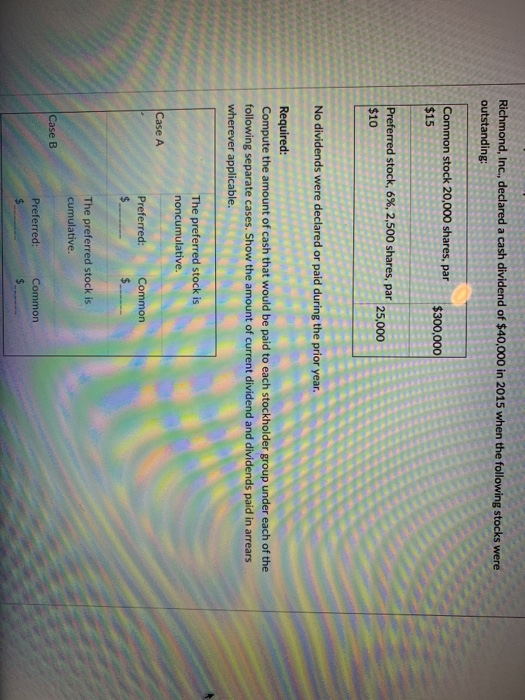

Time Rur Attempt d 2 Hours PROBLEM 1 (20 Points) This problem consists of three separate parts that should be considered independently. PART A (5 Points) The board of directors of Milo Corp. does is deciding whether to declare and pay a cash dividend or to declare and distribute a stock dividend Required: Complete the following chart to show the overall effect on each financial statement item for a cash dividend and a stock dividend. Enter the letter "I" if the effect of the dividend is to increase the financial statement item, a letter "D" if the effect of the dividend is to decrease the financial statement item, or a letter "N" if there is no overall effect. (Hint: Think of the journal entries that would be prepared for a cash dividend and a stock dividend. The overall effect is the net effect from declaration to final payment or distribution.) on Financial Item Statement Cash Dividend Dividend Stock Assets Liabilities Capital stock issued Retained earnings Total stockholders equity PART B (7 Points) Bilko Corporation was just formed. The following accounts with code letters are given below. Required: Indicate the appropriate journal entry for each transaction by entering the code letters and the correct amounts (do not use dollar signs). The transactions, including the example, are not interrelated unless otherwise stated. A Cash F. Accounts payable B. Remaining assetsG. Bonds payable C. Retained earnings D. Common stock, par $20 1. Treasury stock H. Additional paid-in capital No entry to record (Enter O for zero, in the amount column) E. Dividends payable J nsaction Debits Credits Code Amount Code mount Ex. Paid an account payable of $200. F 200 A. 200 Issued 5,000 shares of common stock at $26 per share. 1. issued a 10% stock dividend when the 2. stock was selling at $30 per share. Declared a cash dividend of $1 per share on the shares outstanding. 3. Paid the cash dividend of $1 per share declared earlier (in 3 above). Purchased 100 shares of treasury stock at $27 per share. 5. Sold 30 of the treasury shares 6. acquired in Transaction 5 for $32 per share. Issued a 2-for-1 stock split when the market price was $30 per share. Richmond, Inc., declared a cash dividend of $40,000 in 2015 when the following stocks were outstanding Common stock 20,000 shares, par $15 $300,000 Preferred stock, 6%, 2,500 shares, par $10 25,000 No dividends were declared or paid during the prior year. Compute the amount of cash that would be paid to each stockholder group under each of the following separate cases. Show the amount of current dividend and dividends paid in arrears wherever applicable. The preferred stock is noncumulative. Case A Preferred: Common The preferred stock is cumulative. Preferred Common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts