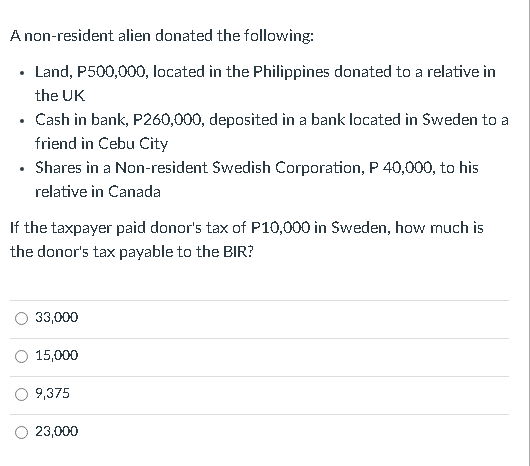

Question: timed task, need help pls thanks A non-resident alien donated the following: Land, P500,000, located in the Philippines donated to a relative in the UK

timed task, need help pls thanks

A non-resident alien donated the following: Land, P500,000, located in the Philippines donated to a relative in the UK Cash in bank, P260,000, deposited in a bank located in Sweden to a friend in Cebu City Shares in a Non-resident Swedish Corporation, P 40,000, to his relative in Canada . If the taxpayer paid donor's tax of P10,000 in Sweden, how much is the donor's tax payable to the BIR? 33,000 15,000 9,375 23,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts