Question: timed task need help pls thanks about transfer taxes Amarried decedent's estate (under CPG) is composed of the following: Conjugal Properties (including family home worth

timed task need help pls thanks

about transfer taxes

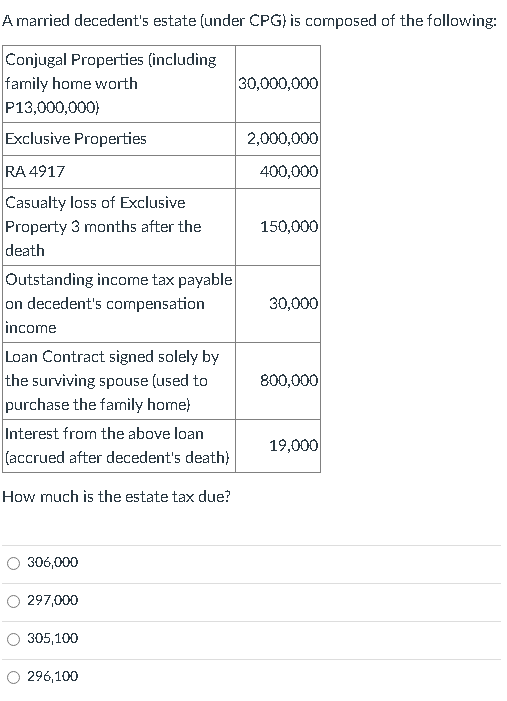

Amarried decedent's estate (under CPG) is composed of the following: Conjugal Properties (including family home worth P13,000,000) 30,000,000 Exclusive Properties 2,000,000 RA 4917 400,000 150,000 30,000 Casualty loss of Exclusive Property 3 months after the death Outstanding income tax payable on decedent's compensation income Loan Contract signed solely by the surviving spouse (used to purchase the family home) Interest from the above loan (accrued after decedent's death) 800,000 19,000 How much is the estate tax due? 306,000 297,000 305,100 296,100

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock