Question: Timothy started working for a fast - food joint three years ago to help pay for his college tuition. He is 2 1 years old,

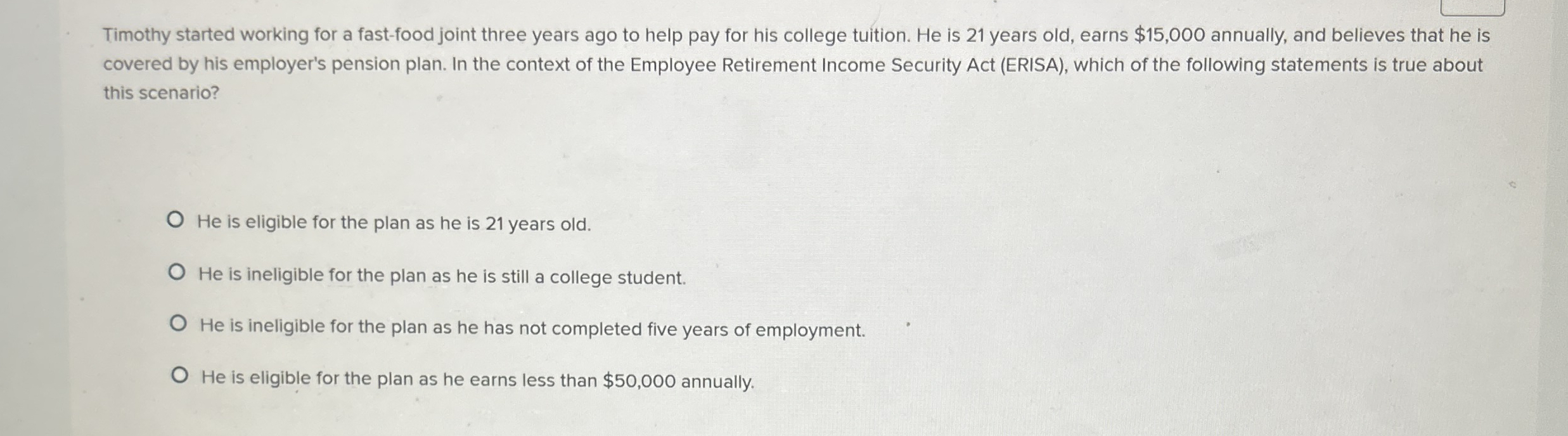

Timothy started working for a fastfood joint three years ago to help pay for his college tuition. He is years old, earns $ annually, and believes that he is covered by his employer's pension plan. In the context of the Employee Retirement Income Security Act ERISA which of the following statements is true about this scenario?

He is eligible for the plan as he is years old.

He is ineligible for the plan as he is still a college student.

He is ineligible for the plan as he has not completed five years of employment.

He is eligible for the plan as he earns less than $ annually.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock