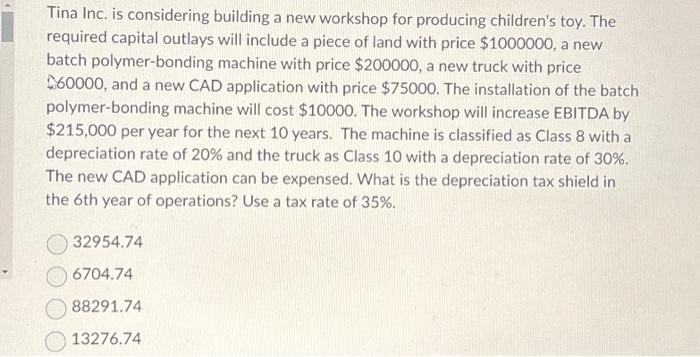

Question: Tina Inc. is considering building a new workshop for producing children's toy. The required capital outlays will include a piece of land with price $1000000,

Tina Inc. is considering building a new workshop for producing children's toy. The required capital outlays will include a piece of land with price $1000000, a new batch polymer-bonding machine with price $200000, a new truck with price $60000, and a new CAD application with price $75000. The installation of the batch polymer-bonding machine will cost $10000. The workshop will increase EBITDA by $215,000 per year for the next 10 years. The machine is classified as Class 8 with a depreciation rate of 20% and the truck as Class 10 with a depreciation rate of 30%. The new CAD application can be expensed. What is the depreciation tax shield in the 6 th year of operations? Use a tax rate of 35%. 32954.74 6704.74 88291.74 13276.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts