Question: To be completed in Visual Basic: You have been asked to write a payroll program for the Lick 2 theStickLollipops Company. Lick 2 theStickLollipops Company

To be completed in Visual Basic:

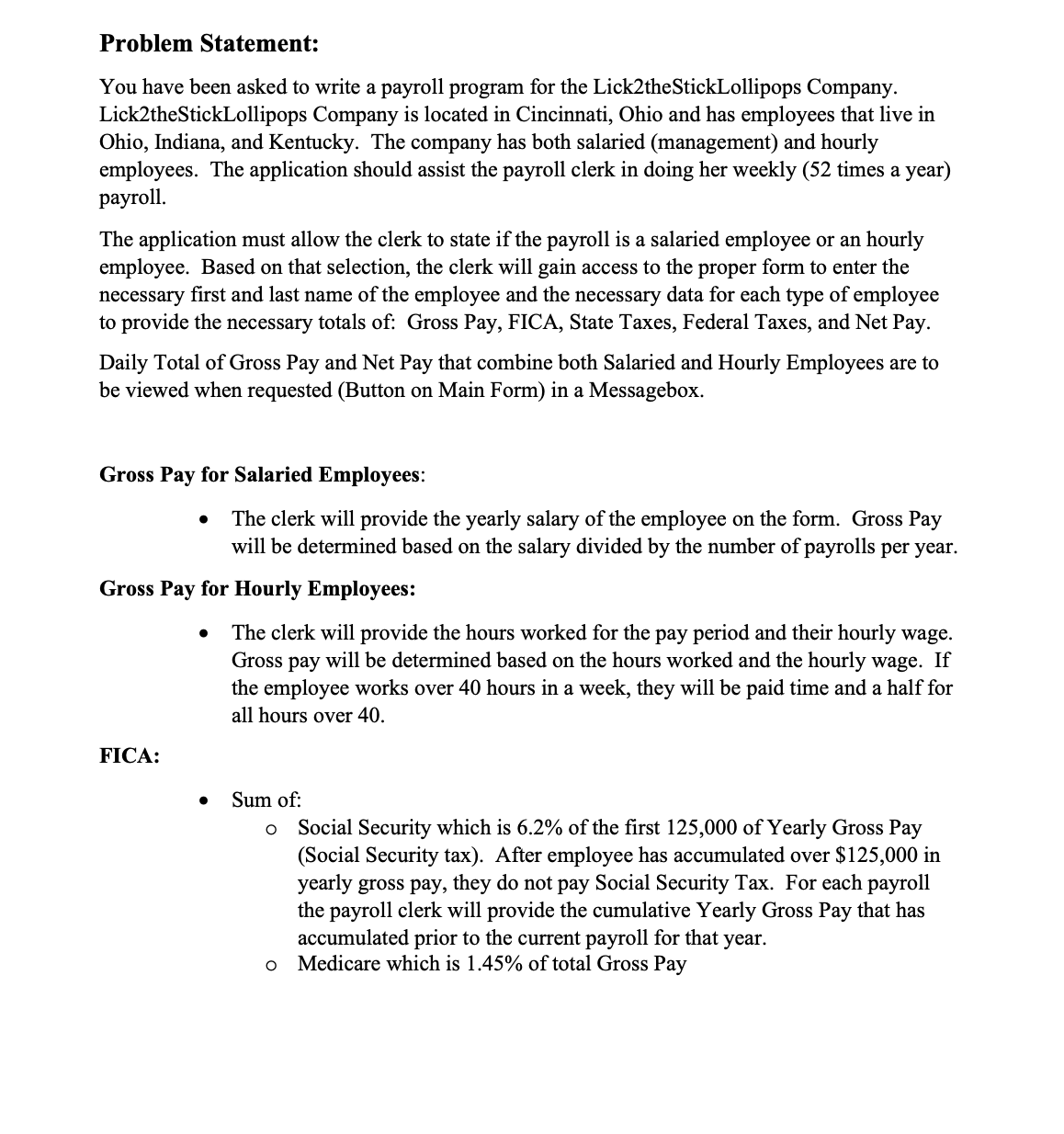

You have been asked to write a payroll program for the LicktheStickLollipops Company.

LicktheStickLollipops Company is located in Cincinnati, Ohio and has employees that live in

Ohio, Indiana, and Kentucky. The company has both salaried management and hourly

employees. The application should assist the payroll clerk in doing her weekly times a year

payroll.

The application must allow the clerk to state if the payroll is a salaried employee or an hourly

employee. Based on that selection, the clerk will gain access to the proper form to enter the

necessary first and last name of the employee and the necessary data for each type of employee

to provide the necessary totals of: Gross Pay, FICA, State Taxes, Federal Taxes, and Net Pay.

Daily Total of Gross Pay and Net Pay that combine both Salaried and Hourly Employees are to

be viewed when requested Button on Main Form in a Messagebox.

Gross Pay for Salaried Employees:

The clerk will provide the yearly salary of the employee on the form. Gross Pay

will be determined based on the salary divided by the number of payrolls per year.

Gross Pay for Hourly Employees:

The clerk will provide the hours worked for the pay period and their hourly wage.

Gross pay will be determined based on the hours worked and the hourly wage. If

the employee works over hours in a week, they will be paid time and a half for

all hours over

FICA:

Sum of:

Social Security which is of the first of Yearly Gross Pay

Social Security tax After employee has accumulated over $ in

yearly gross pay, they do not pay Social Security Tax. For each payroll

the payroll clerk will provide the cumulative Yearly Gross Pay that has

accumulated prior to the current payroll for that year.

Medicare which is of total Gross Pay

State Taxes:

For Ohio: of Weekly Gross Pay For Kentucky: of Weekly Gross Pay For Indiana: of Weekly Gross Pay

Federal Taxes:

Weekly Gross Pay Income Tax Withheld based on the Weekly Gross Pay $ to $ $ $ to $ of amount over $ $ to $ $ of amount over $ $ to $ $ of amount over $ Over $ $ of amount over $

Net Pay:

Gross Pay FICA State Taxes Federal Taxes

Instructions:

This project should be a multiform application that includes:

A main form that allows the user to choose salaried or hourly employee.

A form to handle salaried employees

A form to handle hourly employees.

A standard module must be part of the application that includes common

proceduresfunctions from both forms based on the structure chart.

Use proper controls for all necessary input.

Validation is required for all textbox input. For first and last name, ensure existence. For all

numeric data, ensure for existence, numeric, and

The formatted output on each form should be as follows:

Gross Pay

FICA

State Tax

Federal Tax

Net Pay

A button should be included on the salaried and hourly form to clear the employee's

information and pay results for the next entry.

A button should be included on the salaried and hourly form to exit the form.

A button should be included on the main form to exit the application.

A button should be included on the main form show daily totals in messagebox.

A menu must be included on each form that mimics the buttons on the form.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock