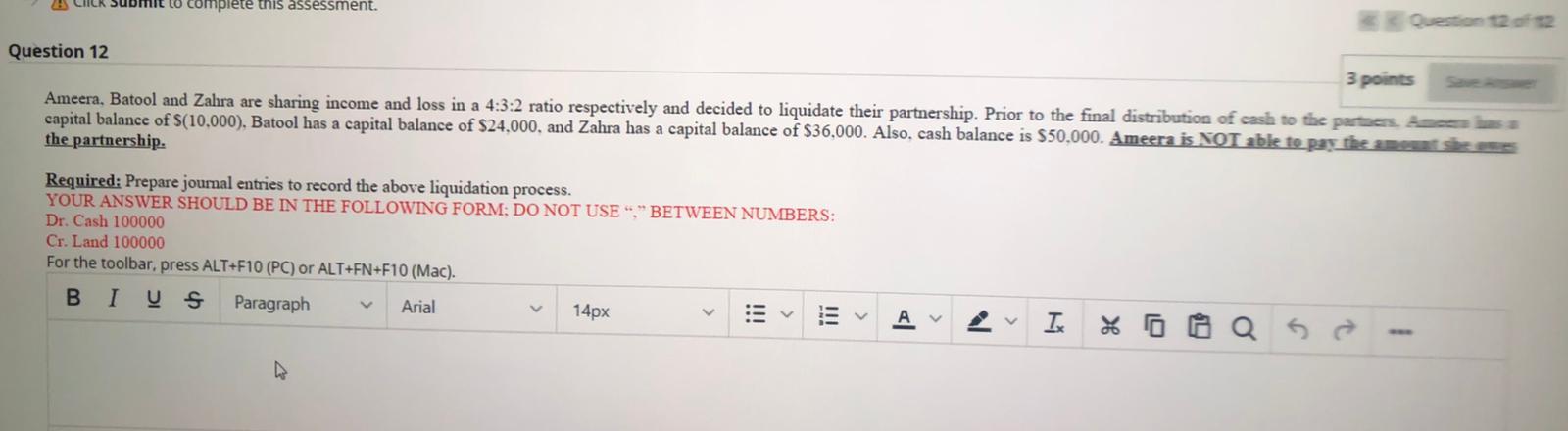

Question: to complete this assessment. Question 12 3 points Ameera, Batool and Zahra are sharing income and loss in a 4:3:2 ratio respectively and decided to

to complete this assessment. Question 12 3 points Ameera, Batool and Zahra are sharing income and loss in a 4:3:2 ratio respectively and decided to liquidate their partnership. Prior to the final distribution of cash to the partes de capital balance of S(10,000), Batool has a capital balance of $24.000, and Zahra has a capital balance of $36,000. Also, cash balance is $50,000. Ameera is NOT able to pay the most the partnership Required: Prepare journal entries to record the above liquidation process. YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM: DO NOT USE" BETWEEN NUMBERS: Dr. Cash 100000 Cr. Land 100000 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI Paragraph Arial 14px V A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts