Question: To develop an example that can be presented to CD's management as an illustration, consider two hypothetical firms Firm U with zero debt financing and

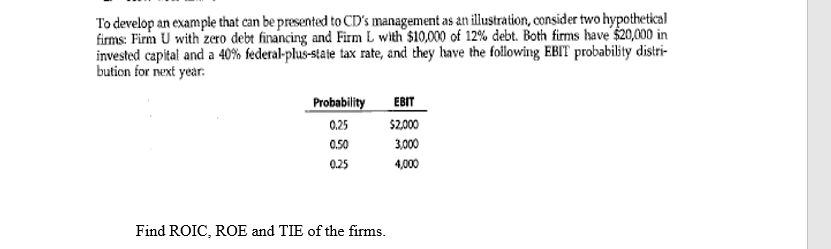

To develop an example that can be presented to CD's management as an illustration, consider two hypothetical firms Firm U with zero debt financing and Firm L with $10,000 of 12% debt. Both firms have $20,000 in invested capital and a 40% federal-plus-state tax rate, and they have the following EBIT probability distri- bution for next year. Probability EBIT $2.000 0.50 3,000 0.25 4,000 0.25 Find ROIC, ROE and TIE of the firms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts