Question: Today is January 1, 2022. Roy will use a single premium to purchase an annuity today. This annuity pays $10,000 at the end of each

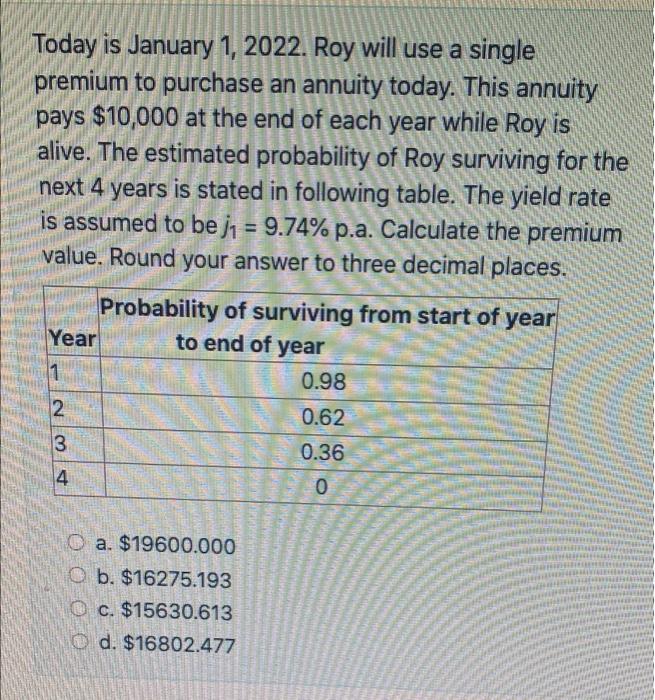

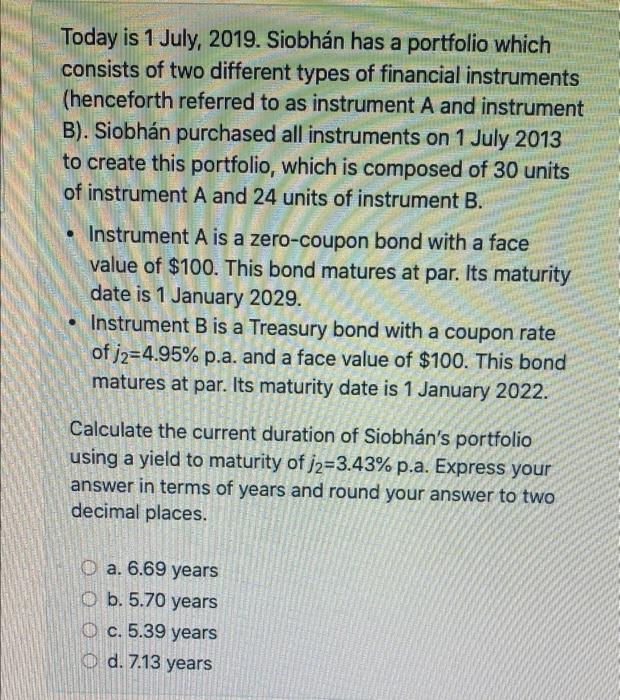

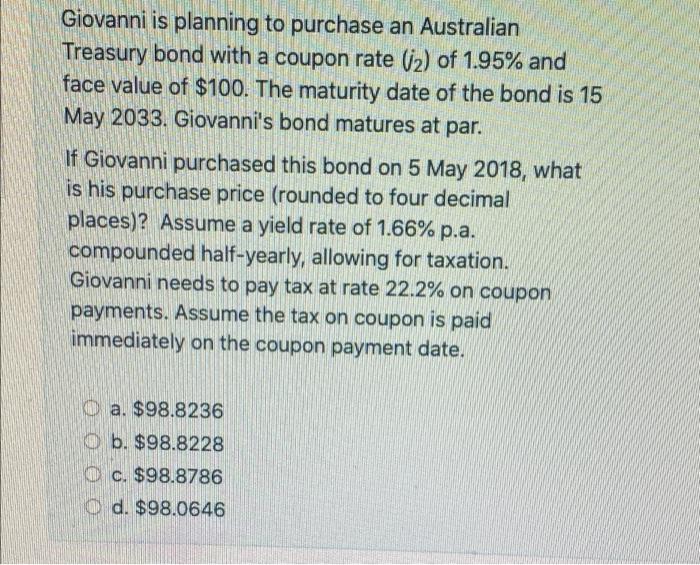

Today is January 1, 2022. Roy will use a single premium to purchase an annuity today. This annuity pays $10,000 at the end of each year while Roy is alive. The estimated probability of Roy surviving for the next 4 years is stated in following table. The yield rate is assumed to be j1 = 9.74% p.a. Calculate the premium value. Round your answer to three decimal places. Probability of surviving from start of year Year to end of year 0.98 2. 0.62 3 0.36 4 0 a. $19600.000 ob. $16275.193 c. $15630.613 d. $16802.477 Today is 1 July, 2019. Siobhn has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Siobhn purchased all instruments on 1 July 2013 to create this portfolio, which is composed of 30 units of instrument A and 24 units of instrument B. Instrument A is a zero-coupon bond with a face value of $100. This bond matures at par. Its maturity date is 1 January 2029. Instrument B is a Treasury bond with a coupon rate of j2=4.95% p.a. and a face value of $100. This bond matures at par. Its maturity date is 1 January 2022. Calculate the current duration of Siobhn's portfolio using a yield to maturity of j2=3.43% p.a. Express your answer in terms of years and round your answer to two decimal places. O a. 6.69 years O b. 5.70 years O c. 5.39 years d. 7.13 years Giovanni is planning to purchase an Australian Treasury bond with a coupon rate (2) of 1.95% and face value of $100. The maturity date of the bond is 15 May 2033. Giovanni's bond matures at par. If Giovanni purchased this bond on 5 May 2018, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 1.66% p.a. compounded half-yearly, allowing for taxation. Giovanni needs to pay tax at rate 22.2% on coupon payments. Assume the tax on coupon is paid immediately on the coupon payment date. 0 a. $98.8236 b. $98.8228 0 c. $98.8786 0 d. $98.0646

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts