Question: Today thyssenkrupp, a German multinational, received an order from an American customer for an amount of 25,000,000. The goods will be shipped in one

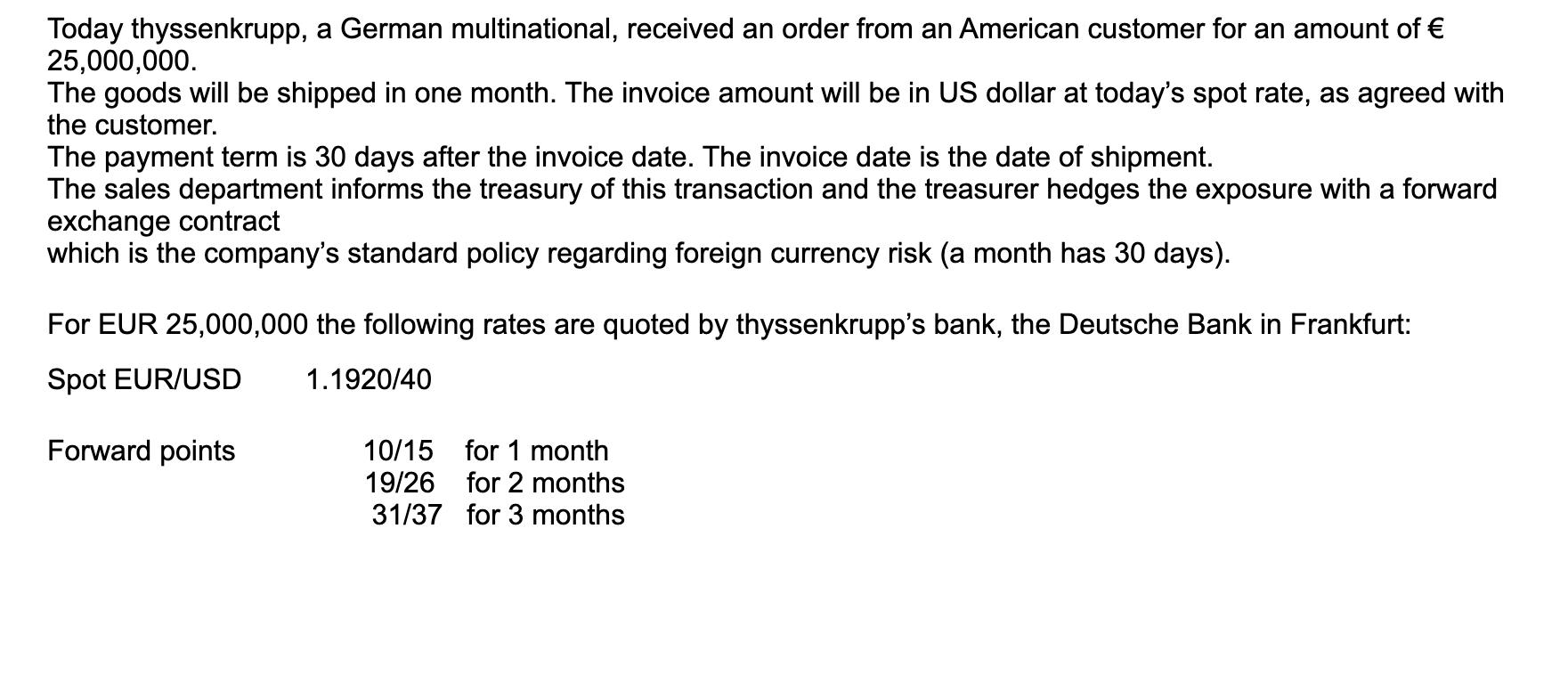

Today thyssenkrupp, a German multinational, received an order from an American customer for an amount of 25,000,000. The goods will be shipped in one month. The invoice amount will be in US dollar at today's spot rate, as agreed with the customer. The payment term is 30 days after the invoice date. The invoice date is the date of shipment. The sales department informs the treasury of this transaction and the treasurer hedges the exposure with a forward exchange contract which is the company's standard policy regarding foreign currency risk (a month has 30 days). For EUR 25,000,000 the following rates are quoted by thyssenkrupp's bank, the Deutsche Bank in Frankfurt: Spot EUR/USD 1.1920/40 Forward points 10/15 for 1 month 19/26 for 2 months 31/37 for 3 months

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Based on the information provided lets calculate the forward exchange rate and the amoun... View full answer

Get step-by-step solutions from verified subject matter experts