Question: Tom and Susan are a young, married couple and plan to have two children over the next 5 years. a) They are evaluating a $150,000,

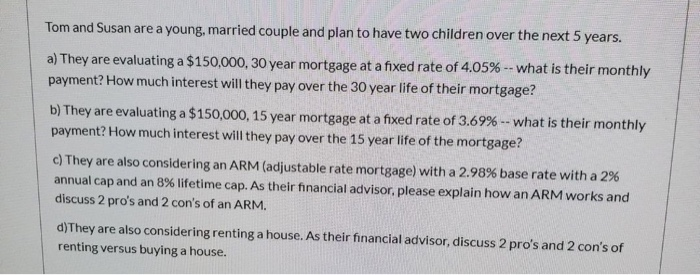

Tom and Susan are a young, married couple and plan to have two children over the next 5 years. a) They are evaluating a $150,000, 30 year mortgage at a fixed rate of 4.05% -- what is their monthly payment? How much interest will they pay over the 30 year life of their mortgage? b) They are evaluating a $150,000, 15 year mortgage at a fixed rate of 3.69% -- what is their monthly payment? How much interest will they pay over the 15 year life of the mortgage? c) They are also considering an ARM (adjustable rate mortgage) with a 2.98% base rate with a 2% annual cap and an 8% lifetime cap. As their financial advisor, please explain how an ARM works and discuss 2 pro's and 2 con's of an ARM. d)They are also considering renting a house. As their financial advisor, discuss 2 pro's and 2 con's of renting versus buying a house

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts