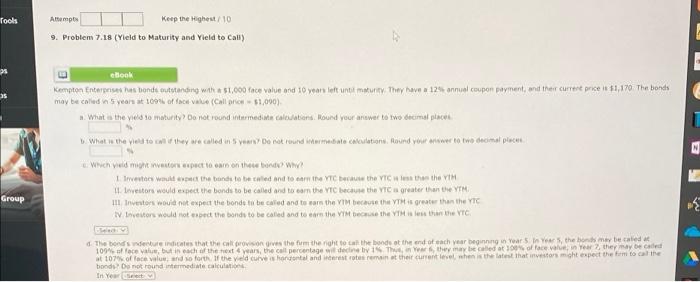

Question: Tools Amps Keep the Highest / 10 9. Problem 7.18 (Yield to Maturity and Yield to Call) ebook Kempton Enterprises tonds outstanding with a $1,000

Tools Amps Keep the Highest / 10 9. Problem 7.18 (Yield to Maturity and Yield to Call) ebook Kempton Enterprises tonds outstanding with a $1,000 face value and 10 years left untiaturty They have a 12 annual coupon payment and the current price is $1,170 The bonds may be called in years at 109 of value (Call price 51,090) What is the view to maturity? Do not round intermediate caldations. Round your answer to two decimal place What is the file to call they we called in se pot round este cavitations. Hound your tower to the decimal place Which might conspection on the bod Investors would expect the band to be called and to eat YCbc the VTC letthethe VM 11. Investors would expect the bonds to be called and to earn they because the YT o greater than theYTH III Investors would not expect the bonds to be called and to earn the VIM because this greater than the YC IV Investors would not be the bonds to be called and to earn the VM Because they set the VTC Group The bonds were indicates that the croones them the right to call the bands at the end of each year beginning Year in the may be called 1094 nace value, but in each of the next years, the call percentage den they may be called to face value they may be called 107 of face and so forth of the veld Curvesoontal and strates remain at their current level when the latest that investors micht expect the time to ine bonde? Do not round Intermediate calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts