Question: Tools Data Window Help File Edit View Insert Format Chapter 12 HW Temg AutoSave OFF Data Review View Tell me Formulas Home Insert Draw Page

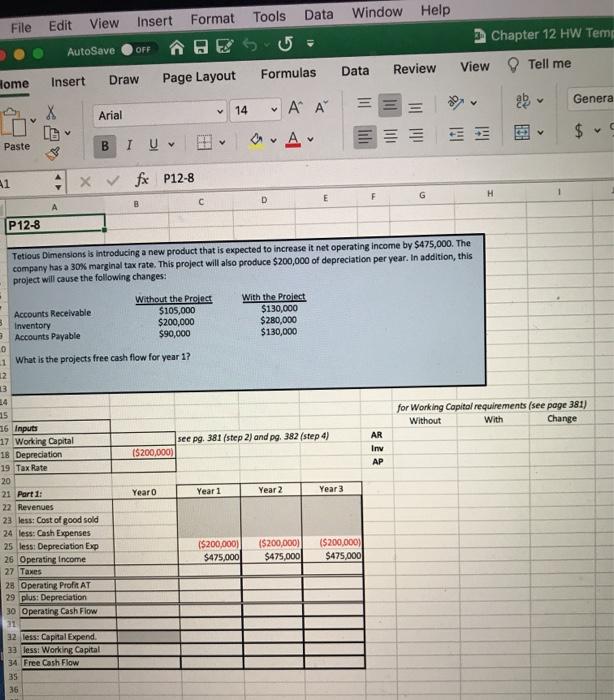

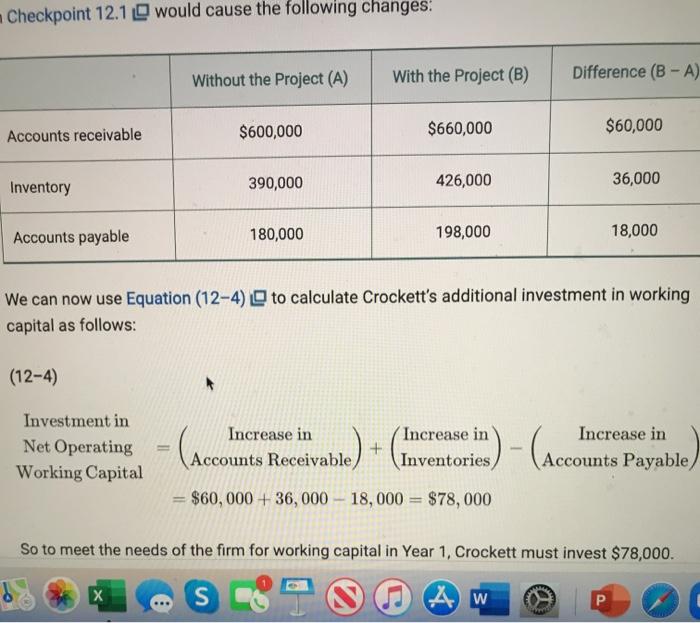

Tools Data Window Help File Edit View Insert Format Chapter 12 HW Temg AutoSave OFF Data Review View Tell me Formulas Home Insert Draw Page Layout v Genera be 14 v ' ' Arial v $ v v Paste Av I U B v A1 x fx P12-8 E F G H D C P12-8 Tetious Dimensions is introducing a new product that is expected to increase it net operating income by $475,000. The company has a 30% marginal tax rate. This project will also produce $200,000 of depreciation per year. In addition, this project will cause the following changes: With the Project $130,000 $280,000 $130,000 Without the Project Accounts Receivable $105,000 3 Inventory $200,000 Accounts Payable $90,000 0 -1 What is the projects free cash flow for year 1? 12 13 for Working Capital requirements (see page 381) Without With Change see pg. 381(step 2) and pg. 382 (step 4) $200,000) AR Inv AP Year Year 1 Year 2 Year 3 15 16 Inputs 17 Working Capital 18 Depreciation 19 Tax Rate 20 21 Part 1: 22 Revenues 23 less: Cost of good sold 24 less: Cash Expenses 25 less: Depreciation Exp 26 Operating Income 27 Taxes 28 Operating Profit AT 29 plus: Depreciation 30 Operating Cash Flow 21 32 less: Capital Expend. 33 less: Working Capital 34 Free Cash Flow 35 36 ($200,000) $475,000 ($200,000) $475,000 ($200,000) $475,000 Checkpoint 12.1 would cause the following changes: Without the Project (A) With the Project (B) Difference (B - A) $600,000 Accounts receivable $660,000 $60,000 Inventory 390,000 426,000 36,000 Accounts payable 180,000 198,000 18,000 We can now use Equation (12-4) to calculate Crockett's additional investment in working capital as follows: (12-4) Investment in Net Operating Working Capital (Accounts Receivable) Increase in Accounts Receivable) + (Increase ins) - (Acounts Payable) Increase in Accounts Payable) = $60,000+ 36,000 - 18,000 = $78,000 So to meet the needs of the firm for working capital in Year 1, Crockett must invest $78,000. S9 A w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts