Question: Topic 1 Regulation & Financing Company Operations: Presentation Question At 30 June 2018, the trial balance of ABC Ltd included the following equity: Share capital

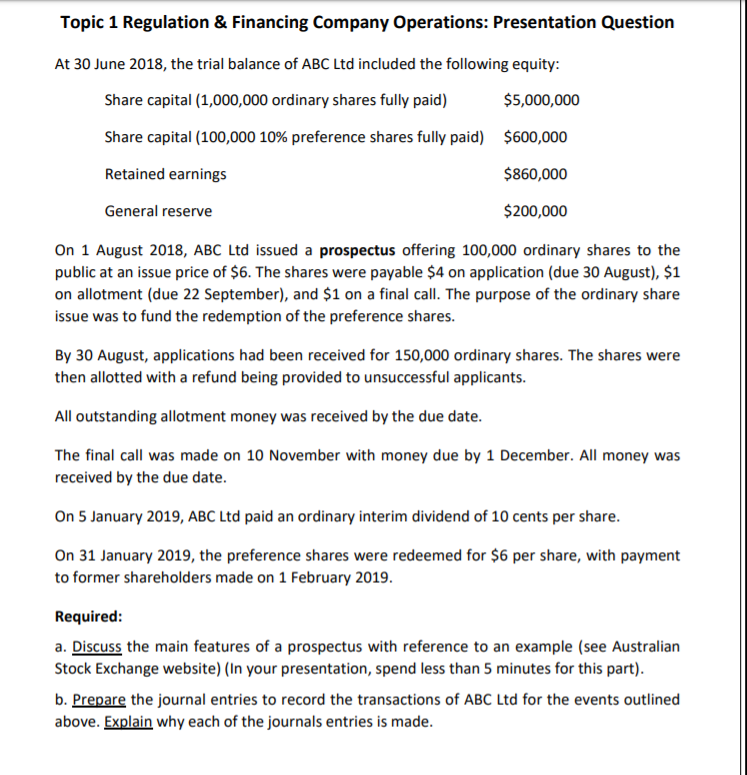

Topic 1 Regulation & Financing Company Operations: Presentation Question At 30 June 2018, the trial balance of ABC Ltd included the following equity: Share capital (1,000,000 ordinary shares fully paid) $5,000,000 Share capital (100,000 10% preference shares fully paid) $600,000 Retained earnings $860,000 General reserve $200,000 On 1 August 2018, ABC Ltd issued a prospectus offering 100,000 ordinary shares to the public at an issue price of $6. The shares were payable $4 on application (due 30 August), $1 on allotment (due 22 September), and $1 on a final call. The purpose of the ordinary share issue was to fund the redemption of the preference shares. By 30 August, applications had been received for 150,000 ordinary shares. The shares were then allotted with a refund being provided to unsuccessful applicants. All outstanding allotment money was received by the due date. The final call was made on 10 November with money due by 1 December. All money was received by the due date. On 5 January 2019, ABC Ltd paid an ordinary interim dividend of 10 cents per share. On 31 January 2019, the preference shares were redeemed for $6 per share, with payment to former shareholders made on 1 February 2019. Required: a. Discuss the main features of a prospectus with reference to an example (see Australian Stock Exchange website) (In your presentation, spend less than 5 minutes for this part). b. Prepare the journal entries to record the transactions of ABC Ltd for the events outlined above. Explain why each of the journals entries is made. Topic 1 Regulation & Financing Company Operations: Presentation Question At 30 June 2018, the trial balance of ABC Ltd included the following equity: Share capital (1,000,000 ordinary shares fully paid) $5,000,000 Share capital (100,000 10% preference shares fully paid) $600,000 Retained earnings $860,000 General reserve $200,000 On 1 August 2018, ABC Ltd issued a prospectus offering 100,000 ordinary shares to the public at an issue price of $6. The shares were payable $4 on application (due 30 August), $1 on allotment (due 22 September), and $1 on a final call. The purpose of the ordinary share issue was to fund the redemption of the preference shares. By 30 August, applications had been received for 150,000 ordinary shares. The shares were then allotted with a refund being provided to unsuccessful applicants. All outstanding allotment money was received by the due date. The final call was made on 10 November with money due by 1 December. All money was received by the due date. On 5 January 2019, ABC Ltd paid an ordinary interim dividend of 10 cents per share. On 31 January 2019, the preference shares were redeemed for $6 per share, with payment to former shareholders made on 1 February 2019. Required: a. Discuss the main features of a prospectus with reference to an example (see Australian Stock Exchange website) (In your presentation, spend less than 5 minutes for this part). b. Prepare the journal entries to record the transactions of ABC Ltd for the events outlined above. Explain why each of the journals entries is made

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts