Question: Topic: Bond and stock ValuationDirection: solve by hand, using a financial calculator or excel. Don't forget to demonstrate how you got your results. Also, make

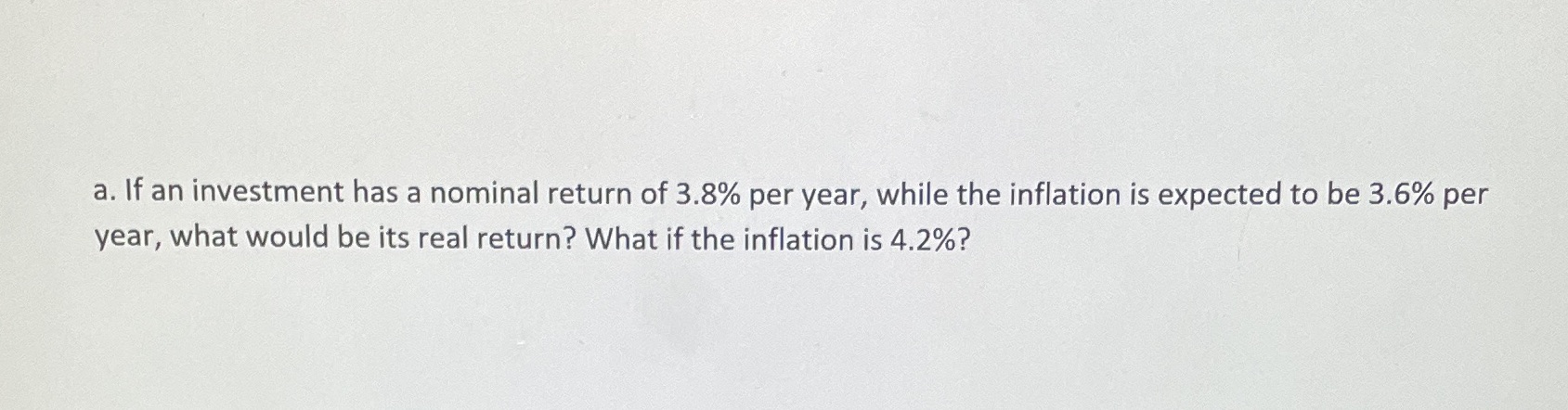

Topic: Bond and stock ValuationDirection: solve by hand, using a financial calculator or excel. Don't forget to demonstrate how you got your results. Also, make sure you explicitly answer the questions when they're based on numerical values or they will be considered unanswered or no partial credits will be granted.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock