Question: Section I: Five (5) Multiple-Choice Questions Alex retired on January 1, 2022, at age 65. He is trying to figure out his 2022 tax situation

Section I: Five (5) Multiple-Choice Questions

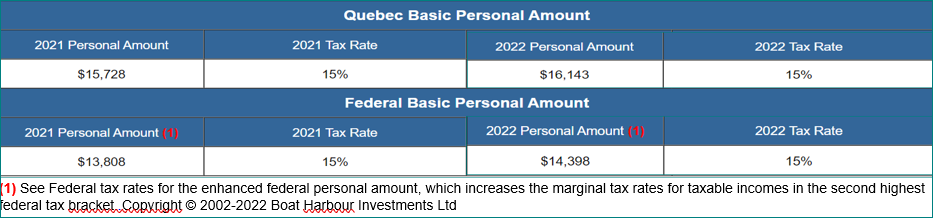

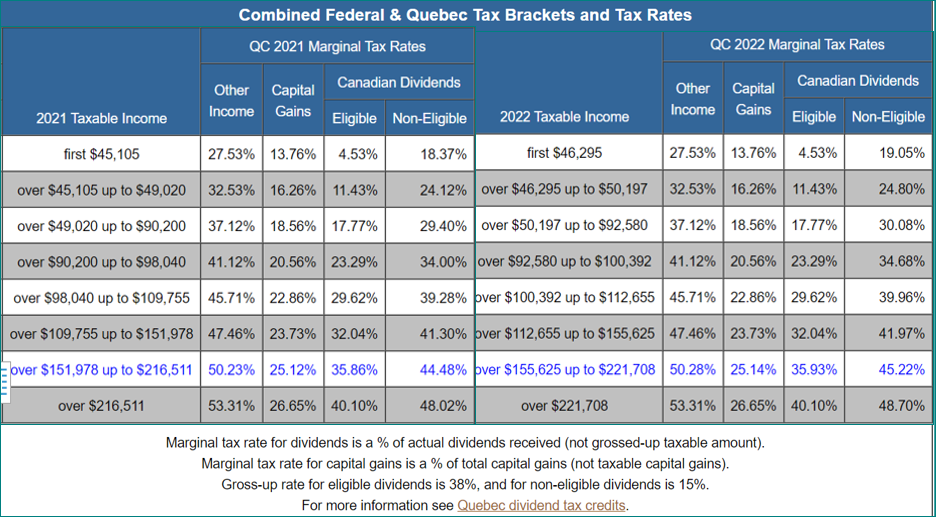

- Alex retired on January 1, 2022, at age 65. He is trying to figure out his 2022 tax situation as his income is so different from what he is used to.What is Alex's estimated marginal rate of tax for 2022 if he withdraws $10,250 from his Registered Retirement Savings Plan (RRSP), withdraws $10,000 from his Tax-Free Savings Account (TFSA), receives a retiree pension from his employer of $17,000, receives his Quebec Pension Plan (QPP) of $15,043 and receives his Old Age Security (OAS) pension benefits of $7,707. (All amounts are annualized and gross. See Table A; ignore Non-Refundable Tax Credits, and Quebec Abatement.)

- 27.53%

- 32.53%

- 37.12%

- 41.12%

- 45.71%

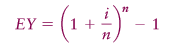

- Liz purchased 2,000 shares of Cosmetic Inc. for a total of $5,300 in April 2021 and was excited to receive a total of $1,400 in dividends throughout the year on these shares. She decides to sell 800 shares in April 2022 when the stock price hits $9.20/share. What is her Return On Investment (ROI) over the one year that she held them?

- 661%

- 561%

- 423%

- 382%

- 274%

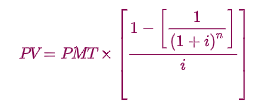

- Lindsay is living with her mother but looking to purchase her first home. She just graduated from Concordia and landed her first full-time job; she has no savings. The property she is eyeing is $150,000. She wants a conventional mortgage. She figures she can save $975 at the beginning of each month and earn 7% compounded monthly. Approximately, how many years will it take her to accumulate the minimum required down payment for a conventional mortgage?

- 3.6 years

- 4.32 years

- 1.98 years

- 2.82 years

- 2.35 years

- For mutual funds, a Balanced Growth and Income Fund contain both growth stocks and stocks that pay high dividends. This type of fund__________________________________________.

- focuses on firms that pay a high level of dividends with less focus on growth.

- distributes dividends periodically, while offering more potential for an increase in the fund's value.

- focuses on firms that are more established than small-cap firms but may have less growth potential.

- focuses on stocks that have potential for above-average growth.

- attempts to mirror the movements of an existing equity index.

- Investors measure the risk of investments to determine the degree of uncertainty surrounding their future returns. Three common measures of an investment's risk are its ___________, ___________________, and its ________________.

- wealth; money; interest rates

- range of returns; the standard deviation of its returns; beta

- sector funds; monetary policy; consumer price index (CPI)

- default rate; US dollar; economic growth

- fiscal policy; inflation; asset allocation

Section I completed, continue to Section II.

Section II: Five (5) Mini-Cases

Mini-Case A:

Ankit invested in a great mutual fund called Fabulous Inc., however, with the pandemic and the effects on the economy, the mutual fund has taken quite a hit. Ankit needs the money and has no choice but to sell in his third year of holding this mutual fund. Three yearsago, Ankitpurchased 2,000 shares for $19.35/share and decided to sell all his shares on April 8, 2022, when the share price was at $8.25/share. His investment broker counselled him not to sell as the fund was a back-end loaded fund.

| Year funds are redeemed/sold | Deferred sales charge |

| Within the first year | 6% |

| In the second year | 5% |

| In the third year | 4% |

| In the fourth year | 3% |

| In the fifth year | 2% |

| In the sixth year | 1% |

| After the sixth year | 0% |

- What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the value of the fund when it is redeemed? (ignore income taxes)

Calculate the amount that Ankit will receive:

- What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the original share price when purchased? (ignore income taxes)

Calculate the amount that Ankit will receive:

- Ankit is a resident of Quebec and in the highest marginal tax bracket. Ankit is trying to figure out his taxes payable based on the following sale of his stocks. Ankit has capital gains of $30,000 that were triggered in January of this year on the sale of other stocks and now has the sale of Fabulous Inc. Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date.(Take your response in a) into consideration and Table A)

Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date:

Mini-Case B:

Yuri is interested in investing and has several questions for you.

- Explain to Yuri what mutual funds are.

______________________________________________________________________________________________________________________________________________________________________

- Explain to Yuri what Exchange Traded Funds (ETFs) are.

______________________________________________________________________________________________________________________________________________________________________

- Yuri likes the mutual fund called RBC Canadian Equity Fund - Series A. Go to the website https://www.rbcgam.com/en/ca/products/mutual-funds/RBF269/detail

Highlight AND underline your response.

- What is the Management Expense Ratio (MER) for this fund?

- What is the minimum amount needed to get into this fund?

- What type of fee is charged: No-load, Front-end load or a Back-end load?

- Is the status of this mutual fund classified as a closed-end or open-end mutual fund?

- What is the risk rating assigned to this fund?

- What type of investor is this RBC Canadian Equity Fund - Series Ainvestment for?

- As of today, what is the asset type mix of this fund?

- As of today, name the top 10 holdings in this fund?

- What is the Net Asset Value (NAV) to buy into this fund today? As the NAV changes at the end of each day, state the date that you looked up the value.

- If Yuri wanted to invest in this fund today and had $2,000 in cash in his Tax-Free Savings Account (TFSA), how many units could he purchase based on your response in ix)?

- Yuri turned 20 years old on February 6, 2022. Assuming we are April 8, 2022, how much more can Yuri put in his Tax-Free Savings Account (TFSA) as of today? Hint: Yuri has only made the $2,000 to his TFSA, as mentioned in x). Do not forget to take carry-forward room into consideration.

Calculate Yuri's TFSA contribution room as of today:

Mini-Case C:

Sandra is the Chief Financial Officer (CFO) in her late father's business (he passed away 5 years ago). She is married to Chris. Both her and Chris just turned 65. They have always lived in Quebec. Chris was a stay-at-home dad and cared for their two children who are now adults. Chris has never worked and has decided to continue to remain at home and now care for their two grandchildren ages 2 and 4.

Both Chris and Sandra are looking to you for the following answers to their questions.

- At age 65, will Chris be eligible for Old Age Security (OAS)?

Yes or No

- At age 65, will Chris be eligible for Quebec Pension Plan (QPP)?

Yes or No

- Chris has never contributed to a Tax-Free Savings Account, how much could he contribute as of today, April 8, 2022? Consider carry forward amounts. $_____________

- Chris has never contributed to a Registered Retirement Savings Account (RRSP), how much could he contribute as of today, April 8, 2022? Consider carry forward amounts.

$____________

- Sandra is looking at her options when it comes to applying for her Quebec Pension Plan (QPP). She knows that the age at which she begins receiving this retirement pension will affect her income for the rest of her life, so she wants to choose wisely. She is weighing two scenarios; one is to retire now and to start receiving this pension at age 65 while the other scenario is to delay the QPP pension to age 70. If she starts receiving her QPP at age 65, she will receive the maximum annual pension of $15,043. What would be the amount of her annual QPP pension if she decides to delay it to age 70?

$______________

- Sandra believes that her Old Age Security (OAS) pension will be subject to clawback. She is trying to understand what this means. The maximum OAS pension in 2022 is $7,707. Sandra's net income is $122,000 (which includes her OAS pension). The clawback starts at the minimum threshold of $81,761 to the maximum threshold of $133,141. How much will Sandra keep of her OAS when the clawback rate is 15%?

Sandra's OAS calculation:

Mini-Case D:

Ellie is 30 years old and just started working for Microsoft. She is paid on the 1st of each month. Upon receipt of her gross monthly salary of $9,000, she immediately contributes $1,000 to the Group Registered Retirement Savings Plan (RRSP) where at the same time, the company matches her contribution. She guesses that she could earn 6% interest compounded weekly over this period.

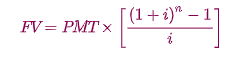

- If she continues to do so for the next 35 years, how much will she have accumulated in her RRSP for her retirement?

Calculate the amount that Ellie will receive:

- For group insurance, Microsoft pays for Long Term Disability (LTD) insurance but requires Ellie to pay for Short Term Disability (STD) Insurance. STD and LTD plans vary per employer. Most STD plans cover 75% of gross salary for sixteen weeks, and then 65% of gross salary potentially to age 65 for LTD, which is also how Microsoft's group insurance pays out.Explain to Ellie the benefits of disability insurance.

______________________________________________________________________________________________________________________________________________________________________

- Ellie was out of work on Short Term Disability leave for one month while she recovered from COVID. How much did Ellie receive from Microsoft during this one month while on leave?

Calculate the amount that Ellie will receive:

Mini-Case E:

Mario has worked hard his entire life and has accumulated significant assets. He is now 85 years old and has decided to make a Will for the very first time. He has always lived in Quebec, has never married, nor had children. He would like to gift his entire estate to charity. His siblings and his many nieces and nephews will be very surprised to not receive an inheritance. He knows that the charity that takes care of the homeless is the right thing to do, especially as no one in his family has ever been close, visited or invited him to family occasions.

- Mario is contemplating three types of Will. List them:1._________________________________________________________________

2._________________________________________________________________

3._________________________________________________________________

- Mario knows that his family will contest his decision and he does not want the charity to have any issues. Which one of the three types of Wills should Mario avoid?

__________________________________________________________________________

- State your reason for your response in b):

________________________________________________________________________________________________________________________________________________________

- Mario called an ambulance recently as he was having difficulty breathing. If he dies before he has a Will prepared, what is this called?

___________________________________________________________________________

TABLE A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts