Question: Topic: multilateral netting Please read carefully A US multinational has its subsidiaries in India, UK and France. The multinational optimizes its inter-subsidiary cash flow using

Topic: multilateral netting Please read carefully

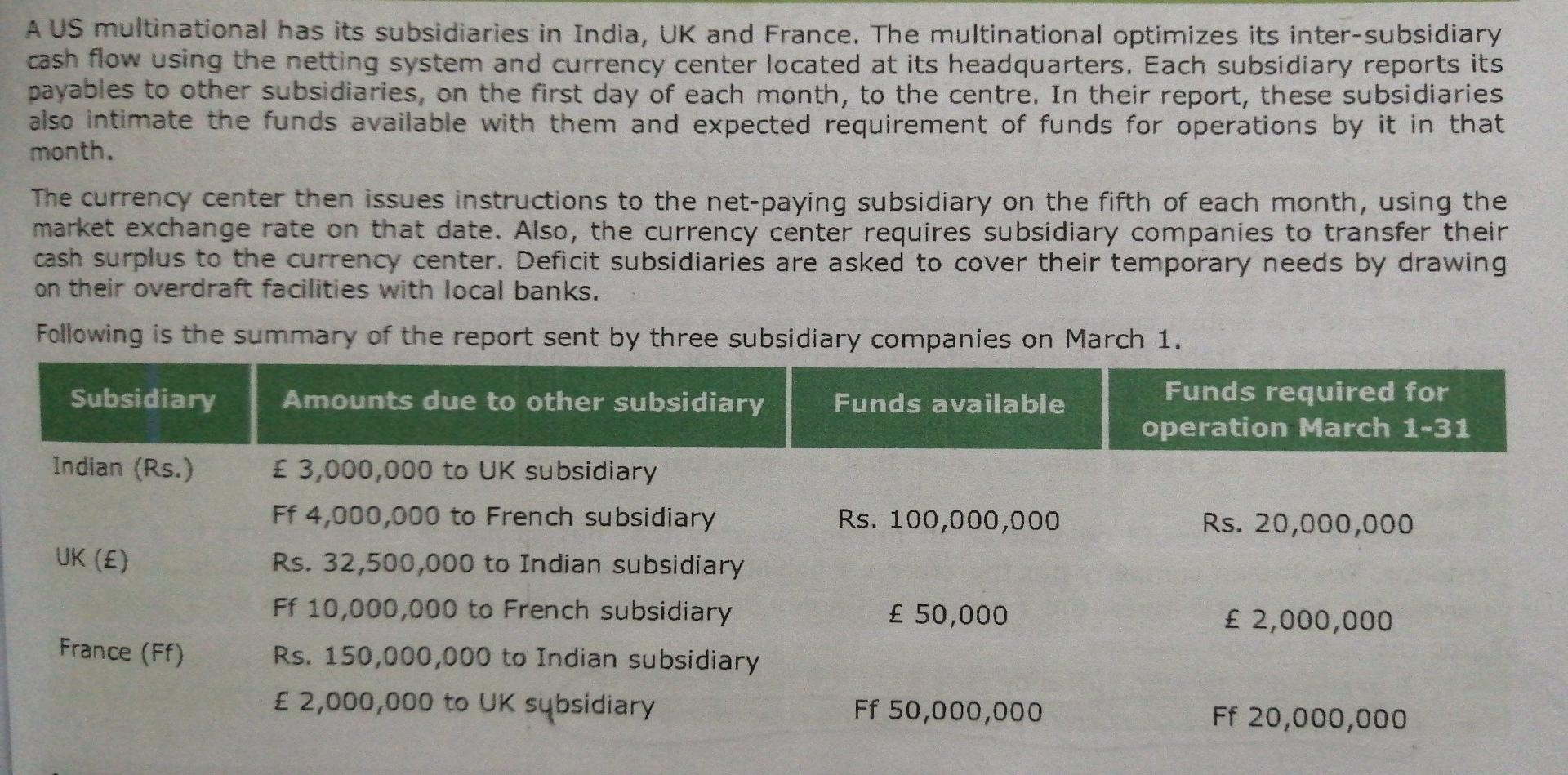

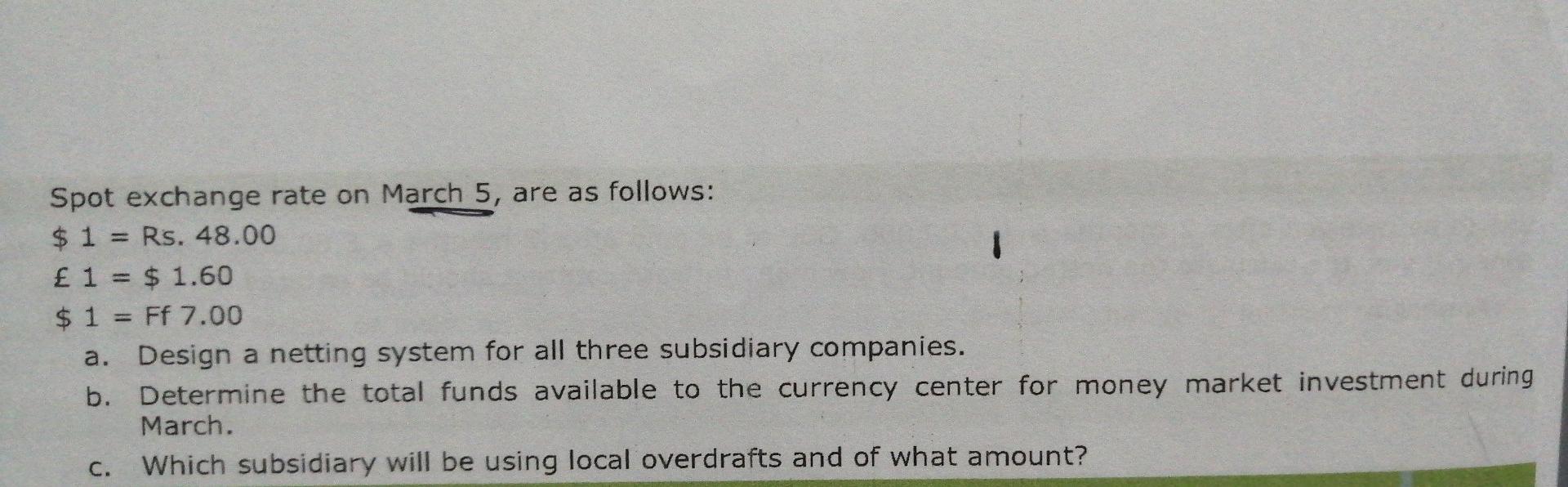

A US multinational has its subsidiaries in India, UK and France. The multinational optimizes its inter-subsidiary cash flow using the netting system and currency center located at its headquarters. Each subsidiary reports its payables to other subsidiaries, on the first day of each month, to the centre. In their report, these subsidiaries also intimate the funds available with them and expected requirement of funds for operations by it in that month. The currency center then issues instructions to the net-paying subsidiary on the fifth of each month, using the market exchange rate on that date. Also, the currency center requires subsidiary companies to transfer their cash surplus to the currency center. Deficit subsidiaries are asked to cover their temporary needs by drawing on their overdraft facilities with local banks. Following is the summary of the report sent by three subsidiary companies on March 1. Subsidiary Funds required for Amounts due to other subsidiary Funds available operation March 1-31 Indian (Rs.) 3,000,000 to UK subsidiary Ff 4,000,000 to French subsidiary Rs. 100,000,000 Rs. 20,000,000 Rs. 32,500,000 to Indian subsidiary Ff 10,000,000 to French subsidiary 50,000 2,000,000 Rs. 150,000,000 to Indian subsidiary 2,000,000 to UK subsidiary Ff 50,000,000 Ff 20,000,000 UK (E) France (Ff) Spot exchange rate on March 5, are as follows: $ 1 = Rs. 48.00 1 1 = $ 1.60 $ 1 = Ff 7.00 a. Design a netting system for all three subsidiary companies. b. Determine the total funds available to the currency center for money market investment during March. C. Which subsidiary will be using local overdrafts and of what amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts