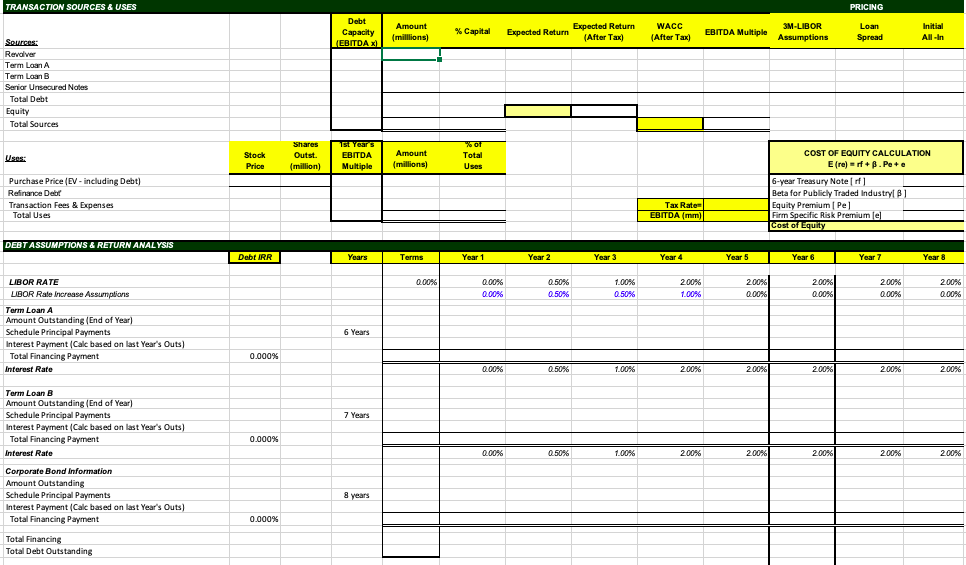

Question: TRANSACTION SOURCES & USES PRICING Debt Capacity (EBITDA X) Amount (millions) % Capital Expected Return Expected Return (After Tax) WACC (After Tax) EBITDA Multiple 3M-LIBOR

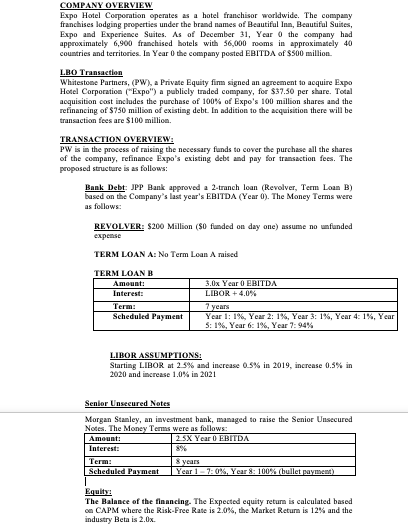

TRANSACTION SOURCES & USES PRICING Debt Capacity (EBITDA X) Amount (millions) % Capital Expected Return Expected Return (After Tax) WACC (After Tax) EBITDA Multiple 3M-LIBOR Assumptions Loan Spread Initial All-In Sources: Revolver Term Loan A Term Loan B Senior Unsecured Notes Total Debt Equity Total Sources Uses: Stock Price Shares Outst. (million) St Year's EBITDA Multiple Amount (millions) Total Uses Purchase Price (EV - including Debt) Refinance Debt Transaction Fees & Expenses Total Uses COST OF EQUITY CALCULATION Ere) -rf .Pe+ 6-year Treasury Note Beta for Publicly Traded Industry B1 Equity Premium Pel Firm Specific Risk Premium el Tos Cost of Equity Tax Rates EBITDA (mm) () DEBT ASSUMPTIONS & RETURN ANALYSIS Debt IRR Years Terms Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 0.00% 0.00% 0.00% 0.50% 0.50% 1.00% 0.50% 2.00% 1.00% 2.00% 0.00% 2.00% 0.00% 2.00% 0.00% 2.00% 0.00% LIBOR RATE LIBOR Rato increase Assumptions Term Loan A A Amount Outstanding (End of Year) Schedule Principal Payments Interest Payment (Calc based on last Year's Outs) Total Financing Payment Interest Rate 6 Years 0.000% 0.00% 0.50% 1.00% 2.00% 200% 2.00% 2.00% 2.00% 7 Years Term Loan B Amount Outstanding (End of Year) Schedule Principal Payments Interest Payment (Calc based on last Year's Outs) Total Financing Payment Interest Rate 0.000% 0.00% 0.50% 1.00% 2.00% 2.00% 2.00% 2.00% 200% Corporate Bond Information Amount Outstanding Schedule Principal Payments Interest Payment (Calc based on last Year's Outs) Total Financing Payment 8 years 0.000% Total Financing Total Debt Outstanding COMPANY OVERVIEW Expo Hotel Corporation operates as a hotel franchisor worldwide. The company franchises lodging properties under the brand names of Beautiful Inn, Beautiful Suites, Expo and Experience Suites. As of December 31, Year the company had approximately 6,900 franchised hotels with 56,000 rooms in approximately 40 countries and territories. In Year the company posted EBITDA of $500 million LBO Transaction Whitestone Partners, (PW), a Private Equity firm signed an agreement to acquire Expo Hotel Corporation ("Expo") a publicly traded company, for $37.50 per share. Total acquisition cost includes the purchase of 100% of Expo's 100 million shares and the refinancing of $750 million of existing debt. In addition to the acquisition there will be transaction fees are $100 million. TRANSACTION OVERVIEW: PW is in the process of raising the necessary funds to cover the purchase all the shares of the company, refinance Expo's existing debt and pay for transaction fees. The proposed structure is as follows: Bank Debt: JPP Bank approved a 2-tranch loan (Revolver, Term Loan B) based on the Company's last year's EBITDA (Year (). The Money Terms were as follows: REVOLVER: $200 Million ($0 funded on day one) assume no unfunded expense TERM LOAN A: No Term Loan A raised TERM LOAN B Amount: Interest: Term: Scheduled Payment 3.0x Year 0 EBITDA LIBOR + 4.0% 7 years Year 1: 1% Year 2: 1%, Year 3: 1%, Year 4: 1%, Year S: 1%, Year 6: 1%, Year 7: 94% LIBOR ASSUMPTIONS: Starting LIBOR at 23% and increase 0.5% in 2019, increase 0.5% in 2020 and increase 1.0% in 2021 Senior Unsecured Notes Morgan Stanley, an investment bank, managed to raise the Senior Unsecured Notes. The Money Terms were as follows: Amount: 2.5X Year 0 EBITDA Interest: 896 Term: Scheduled Payment Year 1ROX Year : 100% (bullet payment) 8 years Equity The Balance of the financing. The Expected equity return is calculated based on CAPM where the Risk-Free Rate is 2.0%, the Market Return is 12% and the industry Beta is 2.0% TRANSACTION SOURCES & USES PRICING Debt Capacity (EBITDA X) Amount (millions) % Capital Expected Return Expected Return (After Tax) WACC (After Tax) EBITDA Multiple 3M-LIBOR Assumptions Loan Spread Initial All-In Sources: Revolver Term Loan A Term Loan B Senior Unsecured Notes Total Debt Equity Total Sources Uses: Stock Price Shares Outst. (million) St Year's EBITDA Multiple Amount (millions) Total Uses Purchase Price (EV - including Debt) Refinance Debt Transaction Fees & Expenses Total Uses COST OF EQUITY CALCULATION Ere) -rf .Pe+ 6-year Treasury Note Beta for Publicly Traded Industry B1 Equity Premium Pel Firm Specific Risk Premium el Tos Cost of Equity Tax Rates EBITDA (mm) () DEBT ASSUMPTIONS & RETURN ANALYSIS Debt IRR Years Terms Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 0.00% 0.00% 0.00% 0.50% 0.50% 1.00% 0.50% 2.00% 1.00% 2.00% 0.00% 2.00% 0.00% 2.00% 0.00% 2.00% 0.00% LIBOR RATE LIBOR Rato increase Assumptions Term Loan A A Amount Outstanding (End of Year) Schedule Principal Payments Interest Payment (Calc based on last Year's Outs) Total Financing Payment Interest Rate 6 Years 0.000% 0.00% 0.50% 1.00% 2.00% 200% 2.00% 2.00% 2.00% 7 Years Term Loan B Amount Outstanding (End of Year) Schedule Principal Payments Interest Payment (Calc based on last Year's Outs) Total Financing Payment Interest Rate 0.000% 0.00% 0.50% 1.00% 2.00% 2.00% 2.00% 2.00% 200% Corporate Bond Information Amount Outstanding Schedule Principal Payments Interest Payment (Calc based on last Year's Outs) Total Financing Payment 8 years 0.000% Total Financing Total Debt Outstanding COMPANY OVERVIEW Expo Hotel Corporation operates as a hotel franchisor worldwide. The company franchises lodging properties under the brand names of Beautiful Inn, Beautiful Suites, Expo and Experience Suites. As of December 31, Year the company had approximately 6,900 franchised hotels with 56,000 rooms in approximately 40 countries and territories. In Year the company posted EBITDA of $500 million LBO Transaction Whitestone Partners, (PW), a Private Equity firm signed an agreement to acquire Expo Hotel Corporation ("Expo") a publicly traded company, for $37.50 per share. Total acquisition cost includes the purchase of 100% of Expo's 100 million shares and the refinancing of $750 million of existing debt. In addition to the acquisition there will be transaction fees are $100 million. TRANSACTION OVERVIEW: PW is in the process of raising the necessary funds to cover the purchase all the shares of the company, refinance Expo's existing debt and pay for transaction fees. The proposed structure is as follows: Bank Debt: JPP Bank approved a 2-tranch loan (Revolver, Term Loan B) based on the Company's last year's EBITDA (Year (). The Money Terms were as follows: REVOLVER: $200 Million ($0 funded on day one) assume no unfunded expense TERM LOAN A: No Term Loan A raised TERM LOAN B Amount: Interest: Term: Scheduled Payment 3.0x Year 0 EBITDA LIBOR + 4.0% 7 years Year 1: 1% Year 2: 1%, Year 3: 1%, Year 4: 1%, Year S: 1%, Year 6: 1%, Year 7: 94% LIBOR ASSUMPTIONS: Starting LIBOR at 23% and increase 0.5% in 2019, increase 0.5% in 2020 and increase 1.0% in 2021 Senior Unsecured Notes Morgan Stanley, an investment bank, managed to raise the Senior Unsecured Notes. The Money Terms were as follows: Amount: 2.5X Year 0 EBITDA Interest: 896 Term: Scheduled Payment Year 1ROX Year : 100% (bullet payment) 8 years Equity The Balance of the financing. The Expected equity return is calculated based on CAPM where the Risk-Free Rate is 2.0%, the Market Return is 12% and the industry Beta is 2.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts