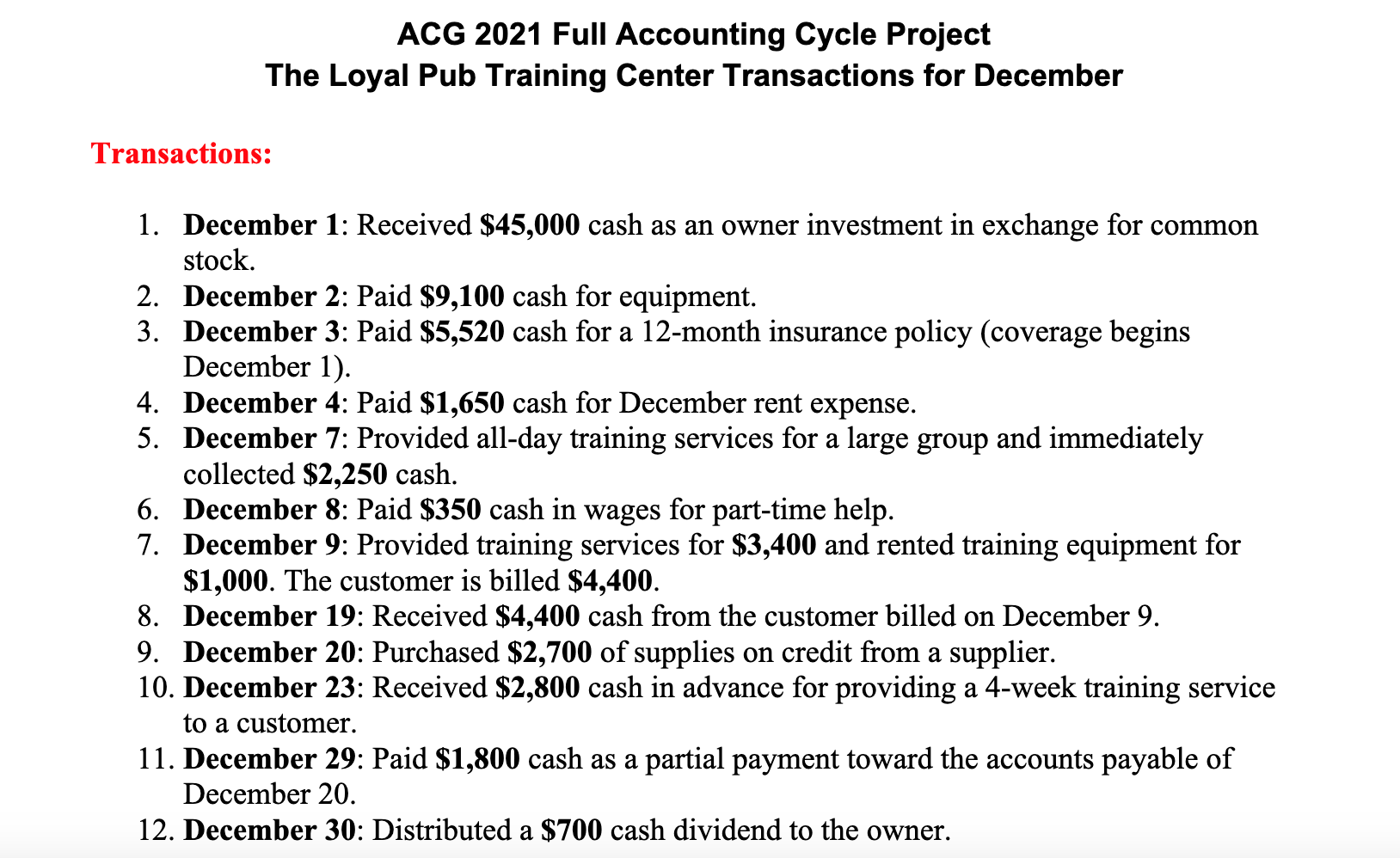

Question: Transactions: 1 . December 1 : Received $ 4 5 , 0 0 0 cash as an owner investment in exchange for common stock. 2

Transactions:

December : Received $ cash as an owner investment in exchange for common

stock.

December : Paid $ cash for equipment.

December : Paid $ cash for a month insurance policy coverage begins

December

December : Paid $ cash for December rent expense.

December : Provided allday training services for a large group and immediately

collected $ cash.

December : Paid $ cash in wages for parttime help.

December : Provided training services for $ and rented training equipment for

$ The customer is billed $

December : Received $ cash from the customer billed on December

December : Purchased $ of supplies on credit from a supplier.

December : Received $ cash in advance for providing a week training service

to a customer.

December : Paid $ cash as a partial payment toward the accounts payable of

December

December : Distributed a $ cash dividend to the owner.

MonthEnd Adjustments December :

One month of the $ insurance policy has expired. This leaves $ not yet

expired.

A physical count of supplies shows that only $ of supplies remain from the $

purchased.

The $ of equipment purchased has a useful life of years months Record one

month of straightline depreciation.

By December onefourth of the $ advanced payment has been earned but not

recorded.

Wages of $ are owed to a parttime employee for work done over the past three weeks

but are not yet paid or recorded.

By December weeks of services out of weeks worth $ per week have been

provided to a customer for a total of $ The business has not yet billed the customer

or recorded the revenue.

Requirements

General Journal tab Prepare journal entries for the first month of operations.

General Ledger tab Post to the ledger.

Unadjusted Trial Balance tab Create the unadjusted Trial Balance.

General Journal tab Prepare any necessary adjusting entries for the current

month.

General Ledger tab Post the adjusting entries to the ledger. Use the previous

ledger balances.

Unadjusted Trial Balance tab Prepare the adjusted Trial Balance.

Trial Balance Tab Create the Trial Balance.

Income Statement tab Create the income statement.

Statement of Retained Earnings tab Create the Statement of Retained

Earnings.

Balance Sheet tab Create the Balance Sheet

PostClosing tab closing entries for the current month and create a post

closing Trial Balance

Worksheet Tab Create the worksheet.

Develop a chart of Accounts based on all the accounts that you used.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock