Question: Transactions are given below answer the questions. TRANSACTIONS 1. The owner invested $94,000 in cash to begin the business. 2. Paid $19,150 in cash for

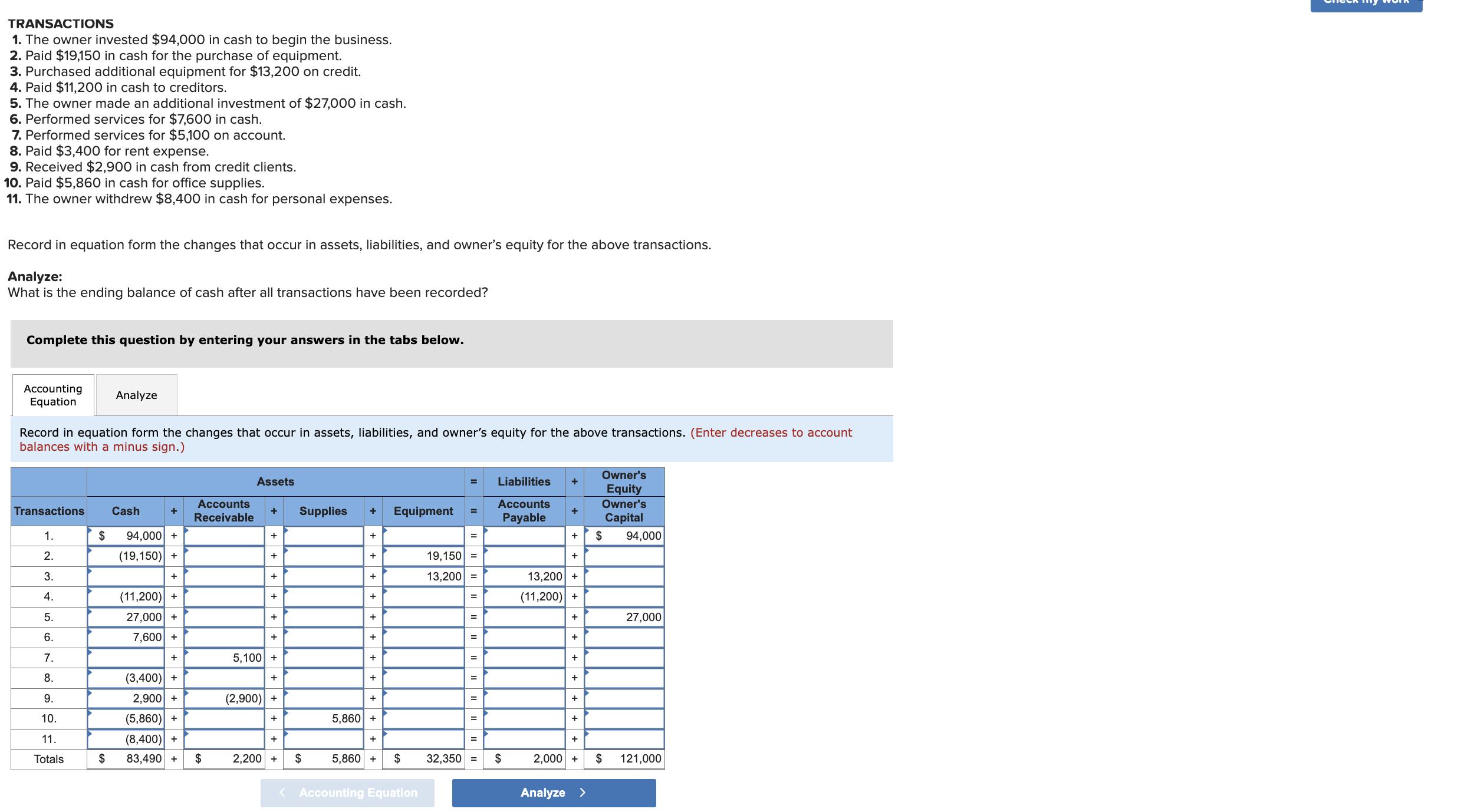

TRANSACTIONS 1. The owner invested $94,000 in cash to begin the business. 2. Paid $19,150 in cash for the purchase of equipment. 3. Purchased additional equipment for $13,200 on credit. 4. Paid $11,200 in cash to creditors. 5. The owner made an additional investment of $27,000 in cash. 6. Performed services for $7,600 in cash. 7. Performed services for $5,100 on account. 8. Paid $3,400 for rent expense. 9. Received $2,900 in cash from credit clients. 10. Paid $5,860 in cash for office supplies. 11. The owner withdrew $8,400 in cash for personal expenses. Record in equation form the changes that occur in assets, liabilities, and owner's equity for the above transactions. Analyze: What is the ending balance of cash after all transactions have been recorded? Complete this question by entering your answers in the tabs below. Accounting Equation Analyze Record in equation form the changes that occur in assets, liabilities, and owner's equity for the above transactions. (Enter decreases to account balances with a minus sign.) Assets Transactions Cash + Accounts Receivable + Supplies + Equipment = Liabilities + Accounts Payable Owner's Equity Owner's + Capital 1. $ 2. 94,000 + (19,150) + + + = + $ 94,000 + + 19,150 = + 3. + + + 13,200 = 13,200+ 4. (11,200) + + + = (11,200) + 5. 27,000 + + = + 27,000 6. 7,600 + + 7. + 5,100 + 8. (3,400) + ++ + = + + = + 9. 2,900 + (2,900) + 10. (5,860) + 11. (8,400) + +++ + = + + 5,860 + = + + + Totals $ 83,490 + $ 2,200 + $ 5,860 + $ 32,350 $ 2,000 + $ 121,000 Accounting Equation Analyze >

Step by Step Solution

There are 3 Steps involved in it

ACCOUNTING EQUATION NO ASSETS LIABILITIES EQUITY CASH SUPPLIES RECE... View full answer

Get step-by-step solutions from verified subject matter experts