Question: transactions for journal entries are below ! please include the year 1 and year 2 t-accounts Required information [The following information applles to the questions

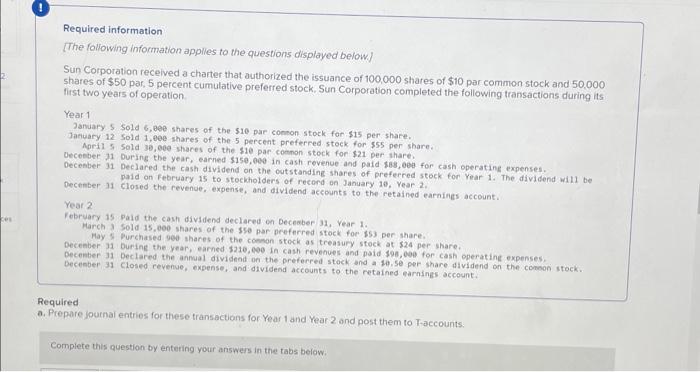

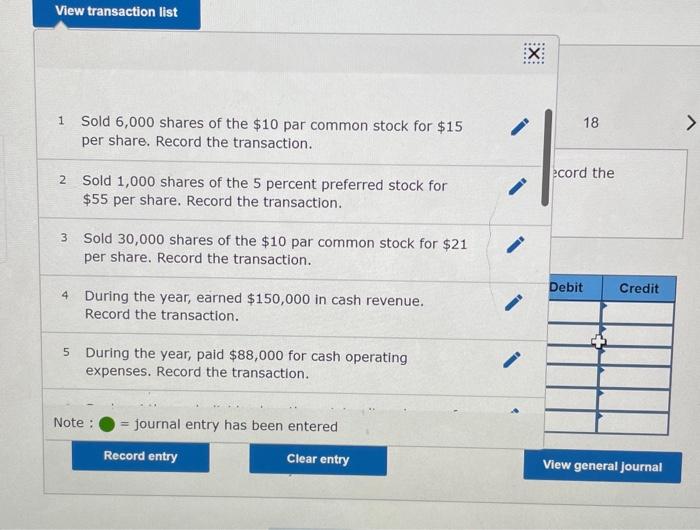

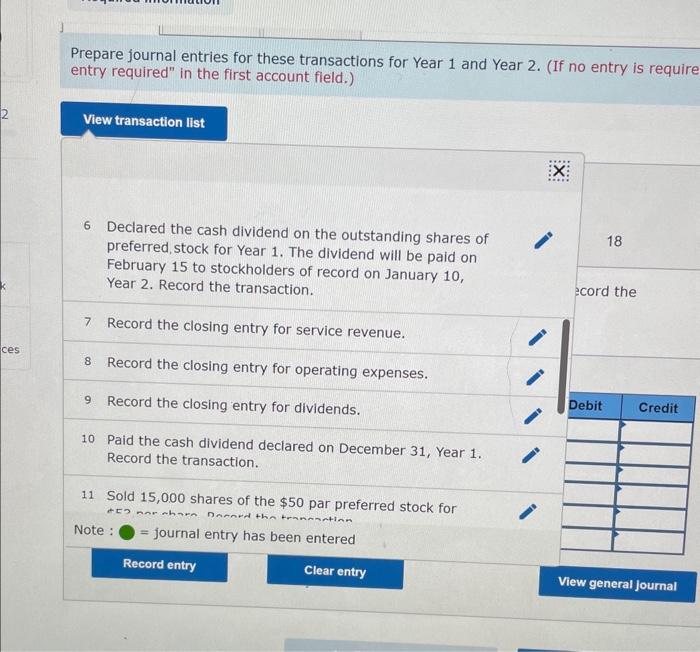

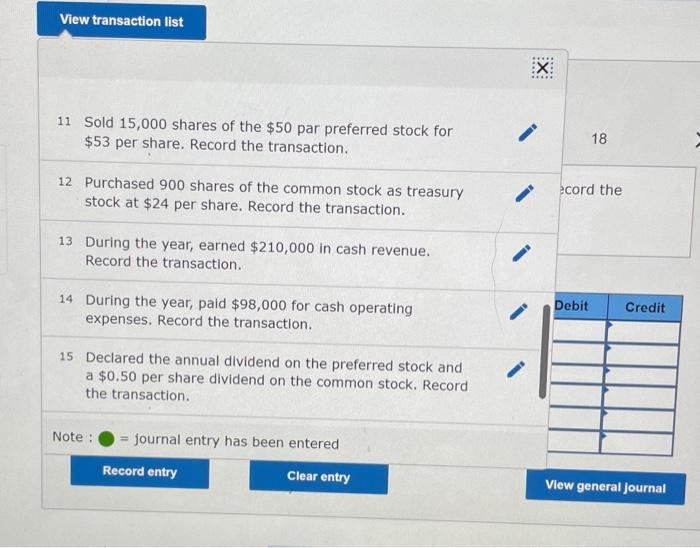

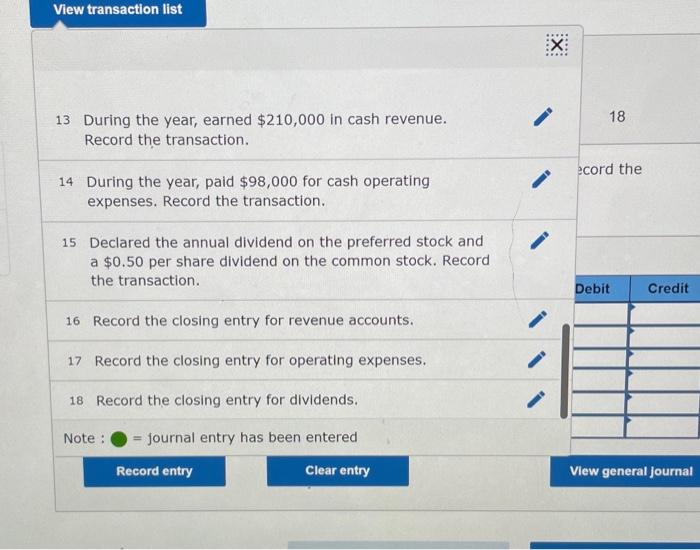

Required information [The following information applles to the questions displayed below. ) Sun Corporation received a charter that authorized the issuance of 100,000 shares of $10 par common stock and 50.000 shares of $50 par, 5 percent cumulative preferred stock, Sun Corporation completed the following transactions during its first two years of operation. Year 1 January 5 sold 6 , bee shares of the 510 par conson stock fon $15 per share. January 12 Sold 1, eee shares of the 5 percent preferred stoek for 555 per share. Apri1 5 sold 30 , c6e shares of the $10 par comnon stock for $21 per share. Vecenber 31 During the year, earned $150,000 in cash revenue and paid $83,000 for cash operatine expenses. Decenber 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on february 15 to stockholders of recond on January 19, Year 2 . Decenter 11 closed the revenue, expense, and dividend accounts to the retained earnings account. Year 2 February 15 Pald the cash divadend declared on Beceaber 31, Year 1. Harch 3 Sold 15, 0eo shares of the sse par peeferred stock for i53 per share. Hay 5 Purchased 9ed shares of the coenon steck as treasury stock at $24 per share. Decenber 31 buring the year, earned $210,000 in cash revenues and paid 396,000 for cash operating expenses. Decenter 31 Declared the anmal dividend on the preferred stock and a 10 . Se per share dividend on the comon stock. Decenber 31 Closed cevenue, expense, and dividend accounts to the retained earnings account. 1 Sold 6,000 shares of the $10 par common stock for $15 per share. Record the transaction. 2 Sold 1,000 shares of the 5 percent preferred stock for \$55 per share. Record the transaction. 3 Sold 30,000 shares of the $10 par common stock for $21 per share. Record the transaction. 4 During the year, earned $150,000 in cash revenue. Record the transaction. 5 During the year, paid $88,000 for cash operating expenses. Record the transaction. Note : = journal entry has been entered Prepare journal entries for these transactions for Year 1 and Year 2. (If no entry is require entry required" in the first account field.) 6 Declared the cash dividend on the outstanding shares of preferred, stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. Record the transaction. 7 Record the closing entry for service revenue. 8 Record the closing entry for operating expenses. 9 Record the closing entry for dividends. 10 Paid the cash dividend declared on December 31 , Year 1. Record the transaction. 11 Sold 15,0.00 shares of the $50 par preferred stock for Note : = journal entry has been entered 11 Sold 15,000 shares of the $50 par preferred stock for $53 per share. Record the transaction. 12 Purchased 900 shares of the common stock as treasury stock at \$24 per share. Record the transaction. 13 During the year, earned $210,000 in cash revenue. Record the transaction. 14 During the year, paid $98,000 for cash operating expenses. Record the transaction. 15 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common stock. Record the transaction. Note : = journal entry has been entered 13 During the year, earned $210,000 in cash revenue. Record the transaction. 14 During the year, paid $98,000 for cash operating expenses. Record the transaction. 15 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common stock. Record the transaction. 16 Record the closing entry for revenue accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts