Question: 1. A firm has a project X with cash flows of S-12,000, $5,000, $6,000, $2000, $800 in periods 0 to 4 respectively. (a) Calculate its

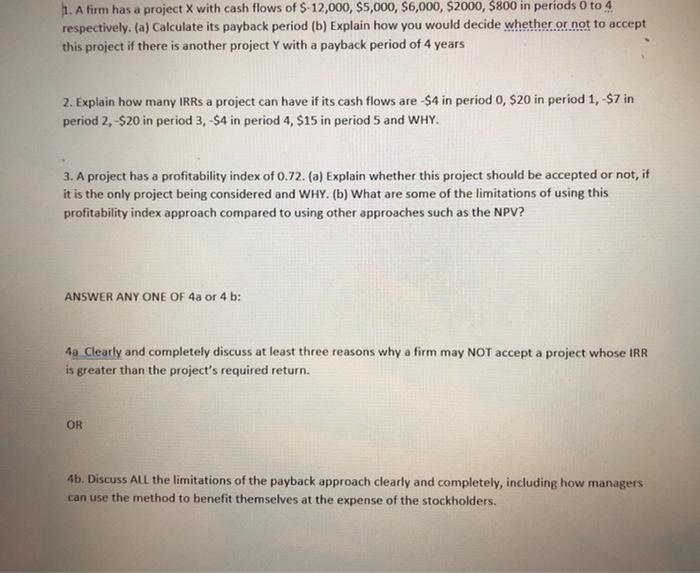

1. A firm has a project X with cash flows of S-12,000, $5,000, $6,000, $2000, $800 in periods 0 to 4 respectively. (a) Calculate its payback period (b) Explain how you would decide whether or not to accept this project if there is another project Y with a payback period of 4 years 2. Explain how many IRRs a project can have if its cash flows are -$4 in period 0, $20 in period 1, -$7 in period 2, $20 in period 3,-$4 in period 4, $15 in period 5 and WHY. 3. A project has a profitability index of 0.72. (a) Explain whether this project should be accepted or not, if it is the only project being considered and WHY. (b) What are some of the limitations of using this profitability index approach compared to using other approaches such as the NPV? ANSWER ANY ONE OF 4a or 4 b: 4a Clearly and completely discuss at least three reasons why a firm may NOT accept a project whose IRR is greater than the project's required return. OR 4b. Discuss ALL the limitations of the payback approach clearly and completely, including how managers can use the method to benefit themselves at the expense of the stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts