Question: 1. What is the expected return on a portfolio that will decline in value by 13% in a recession, will increase by 16% in normal

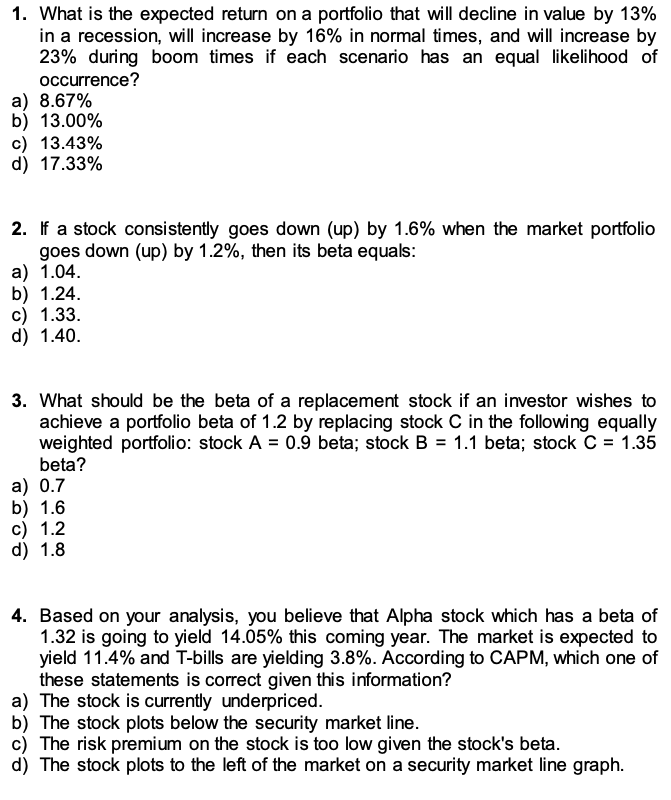

1. What is the expected return on a portfolio that will decline in value by 13% in a recession, will increase by 16% in normal times, and will increase by 23% during boom times if each scenario has an equal likelihood of occurrence? a) 8.67% b) 13.00% c) 13.43% d) 17.33% 2. If a stock consistently goes down (up) by 1.6% when the market portfolio goes down (up) by 1.2%, then its beta equals: a) 1.04. b) 1.24. c) 1.33. d) 1.40. 3. What should be the beta of a replacement stock if an investor wishes to achieve a portfolio beta of 1.2 by replacing stock C in the following equally weighted portfolio: stock A = 0.9 beta; stock B = 1.1 beta; stock C = 1.35 beta? a) 0.7 b) 1.6 c) 1.2 d) 1.8 4. Based on your analysis, you believe that Alpha stock which has a beta of 1.32 is going to yield 14.05% this coming year. The market is expected to yield 11.4% and T-bills are yielding 3.8%. According to CAPM, which one of these statements is correct given this information? a) The stock is currently underpriced. b) The stock plots below the security market line. c) The risk premium on the stock is too low given the stock's beta. d) The stock plots to the left of the market on a security market line graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts