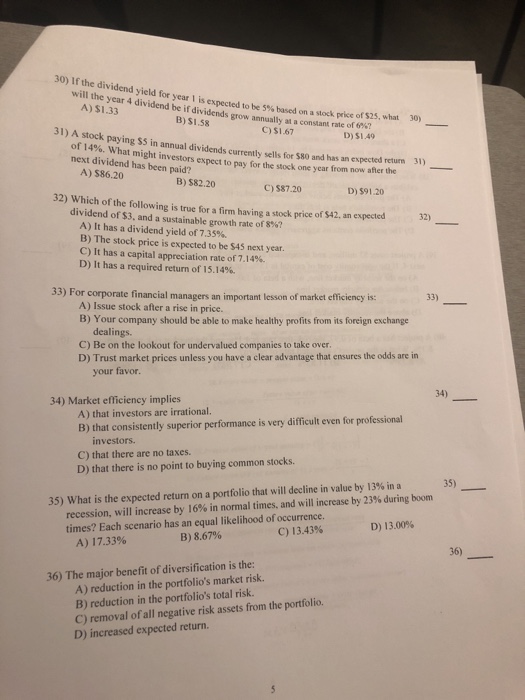

Question: 30) If the dividend yield for year I is expected to be year 4 dividend be if dividends grow annually at a constant rate of

30) If the dividend yield for year I is expected to be year 4 dividend be if dividends grow annually at a constant rate of 5%based on a stock price ofS25. what A) $1.33 30) B) S1.58 C) S1.67 D) $1.49 31) A stock paying S5 in annual dividends currently sells for $80 and has an espected returnm 31) of 14%. What might investors expect to pay for the stock one year from now after the next dividend has been paid? A) S86.20 B) $82.20 C) $87.20 D) $91.20 32) Which of the following is true for a firm having a stock price of $42, an expected 2) dividend of $3, and a sustainable growth rate of 8,67 A) It has a dividend yield of 7.35%. B) The stock price is expected to be $45 next year. C) It has a capital appreciation rate of 7.14%. D) It has a required return of 15.14%. 33) For corporate financial managers an important lesson of market efficiency is: A) Issue stock after a rise in price. B) Your company should be able to make healthy profits from its foreign exchange dealings. C) Be on the lookout for undervalued companies to take over. D) Trust market prices unless you have a clear advantage that ensures the odds are in your favor. 34) 34) Market efficiency implies A) that investors are irrational B) that consistently superior performance is very difficult even for professional investors. C) that there are no taxes. D) that there is no point to buying common stocks. 35) recession, will increase by 16% in normal times, and will increase by 23% during boom times? Each scenario has an equal likelihood of occurrence 35) What is the expected return on a portfolio that will decline in value by 13% in a D) 13.00% C) 13.43% B) 8.67% A) 17.33% 36) A) reduction in the portfolio's market risk. B) reduction in the portfolio's total risk C) removal of all negative risk assets from the portfolio. D) increased expected return 36) The major benefit of diversification is the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts