Question: 10 Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT)

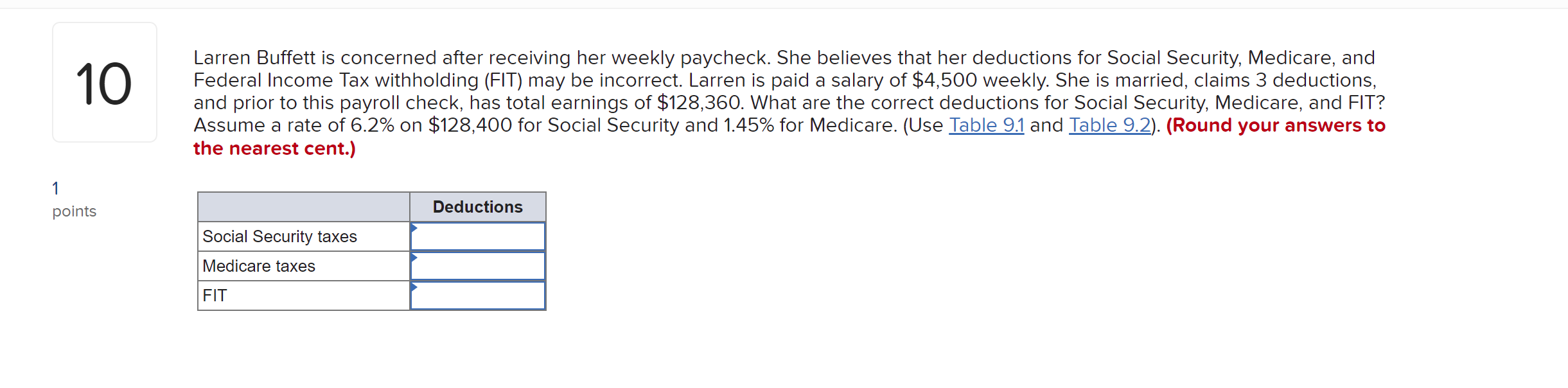

10 Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $4,500 weekly. She is married, claims 3 deductions, and prior to this payroll check, has total earnings of $128,360. What are the correct deductions for Social Security, Medicare, and FIT? Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. (Use Table 9.1 and Table 9.2). (Round your answers to the nearest cent.) Deductions Social Security taxes Medicare taxes FIT 1 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts