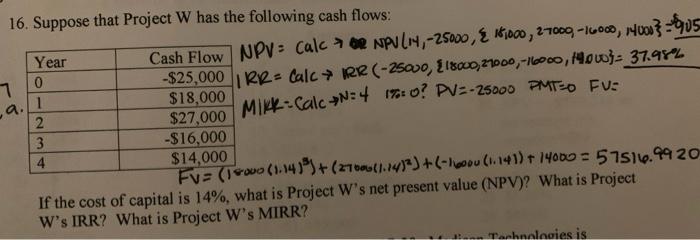

Question: 16. Suppose that Project W has the following cash flows: Year Cash Flow NPV = Cal 7 de NPULA4,-25000, 1,000, 27000, -16000, 14003-905 0 -$25,000

16. Suppose that Project W has the following cash flows: Year Cash Flow NPV = Cal 7 de NPULA4,-25000, 1,000, 27000, -16000, 14003-905 0 -$25,000 RR - Calc + Re (-25000, 218000,21000,-16000, 14000)- 37.982 1 $18,000 Mikk-Calc N=4 14:0? PV=-25000 PMTO Fus 2 $27,000 3 -$16,000 $14,000 Fv= (1400(1.141)+(27003(1.432) + (-10o (1.141) + 14000 = 57516.99 20 If the cost of capital is 14%, what is Project W's net present value (NPV)? What is Project W's IRR? What is Project W's MIRR? 4 Tarhnaladies is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock