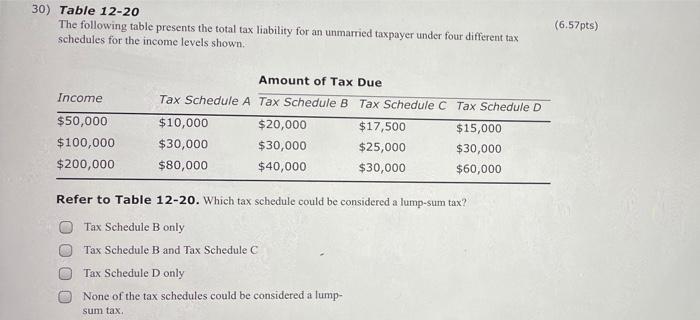

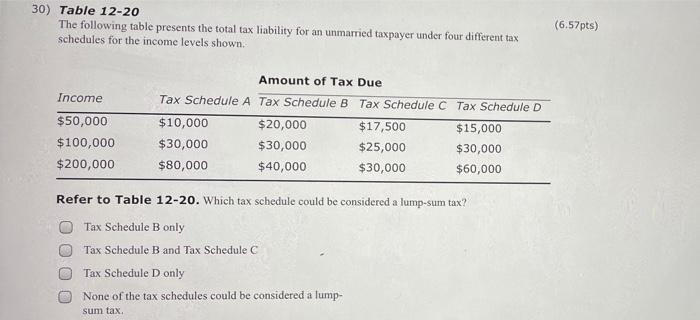

Question: 30) Table 12-20 The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

30) Table 12-20 The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown. (6.57pts) Income $50,000 $100,000 $200,000 Amount of Tax Due Tax Schedule A Tax Schedule B Tax Schedule C Tax Schedule D $10,000 $20,000 $17,500 $15,000 $30,000 $30,000 $25,000 $30,000 $80,000 $40,000 $30,000 $60,000 Refer to Table 12-20. Which tax schedule could be considered a lump-sum tax? Tax Schedule B only Tax Schedule B and Tax Schedule C Tax Schedule D only None of the tax schedules could be considered a lump- sum tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts