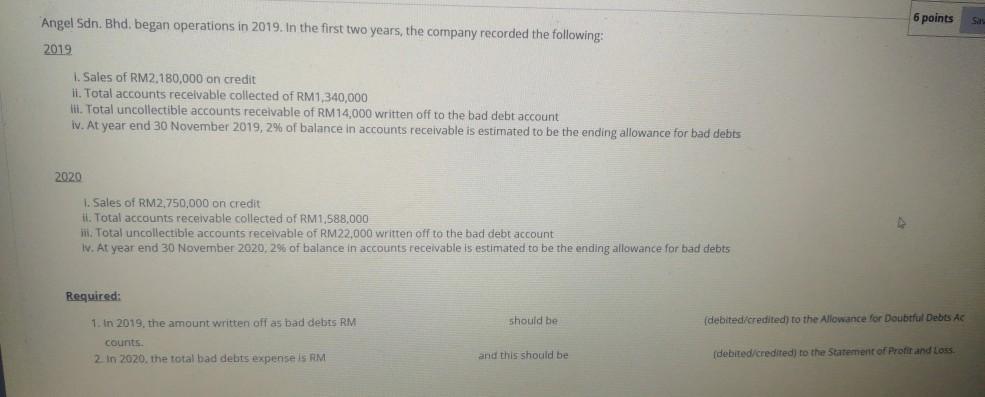

Question: 6 points Angel Sdn. Bhd, began operations in 2019. In the first two years, the company recorded the following: 2019 1. Sales of RM2,180,000 on

6 points Angel Sdn. Bhd, began operations in 2019. In the first two years, the company recorded the following: 2019 1. Sales of RM2,180,000 on credit il. Total accounts receivable collected of RM1,340,000 lii. Total uncollectible accounts receivable of RM14,000 written off to the bad debt account iv. At year end 30 November 2019,2% of balance in accounts receivable is estimated to be the ending allowance for bad debts 2020 1. Sales of RM2,750,000 on credit il. Total accounts receivable collected of RM1.588,000 m. Total uncollectible accounts receivable of RM22,000 written off to the bad debt account iv. At year end 30 November 2020,2% of balance in accounts receivable is estimated to be the ending allowance for bad debts Required: should be (debited/credited) to the Allowance for Doubtful Debts Ac 1. In 2019, the amount written off as bad debts RM counts 2. in 2020, the total bad debts expenses RM and this should be debited/credited) to the Statement of Profit and Loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts