Question: A. Why stock repurchase could cause an increase in stock price of the company? Explain your rationale. B. Company A has a beta of 1.6,

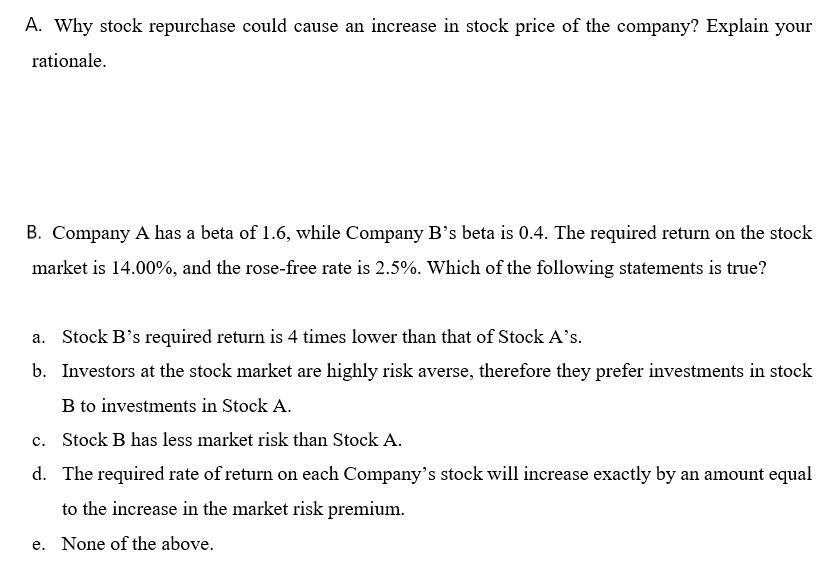

A. Why stock repurchase could cause an increase in stock price of the company? Explain your rationale. B. Company A has a beta of 1.6, while Company Bs beta is 0.4. The required return on the stock market is 14.00%, and the rose-free rate is 2.5%. Which of the following statements is true? a. Stock B's required return is 4 times lower than that of Stock A's. b. Investors at the stock market are highly risk averse, therefore they prefer investments in stock B to investments in Stock A. c. Stock B has less market risk than Stock A. d. The required rate of return on each Company's stock will increase exactly by an amount equal to the increase in the market risk premium. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts