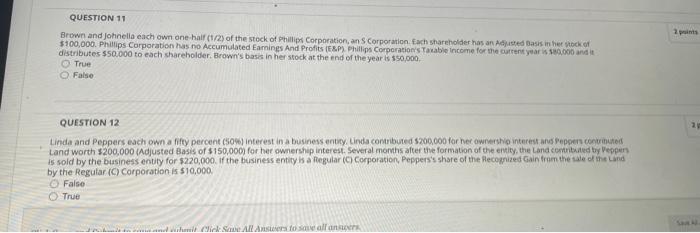

Question: Brown and johnelio each own one half (t /2) of the stock of Phillip Corporation, an S Corporation. fach shareholder has an Adi ived basis

Brown and johnelio each own one half (t /2) of the stock of Phillip Corporation, an S Corporation. fach shareholder has an Adi ived basis in her stock of 5100,000. Phillips Corporation has no Accumutated Earnings And Profits (EEP). Phillips Corporation's Tavable income for the cartent year is sug.000 and it. distributes $50.000 to each shareholder. Brown's basis in her stock at the end of the year is $50,000, True False QUESTION 12 Linda and Peppers each own a fifty percent csow) interest in a business entity, Linda contributed s200, 000 for her ownershig interest ans Pepcens conuinused Land worth $200,000 (Adjusted Basis of $150,000 for her ownership interest. Several months after the formation of the entity, the Land contritaited ty Veppen is sold by the business entity for $220,000. If the business entity its a flegular (C) Corporation, Peppers's share of the flecolpized Gain frnm the iale of its Land by the Regular (C) Corporation is 510,000 . False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts