Question: Case Construction Company, a three-year-old business, provides contracting and construction services to a variety of clients. Glven that each construction job is different from the

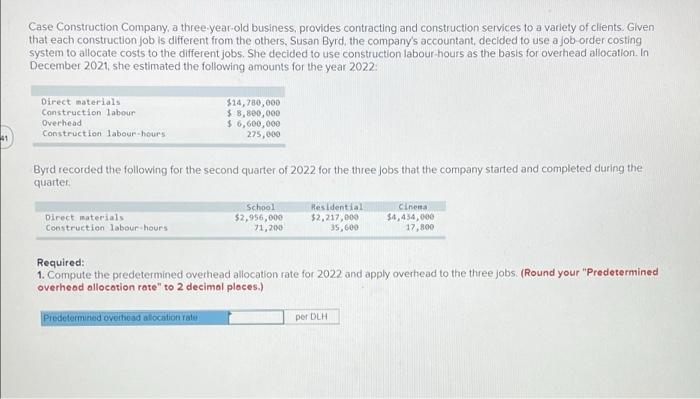

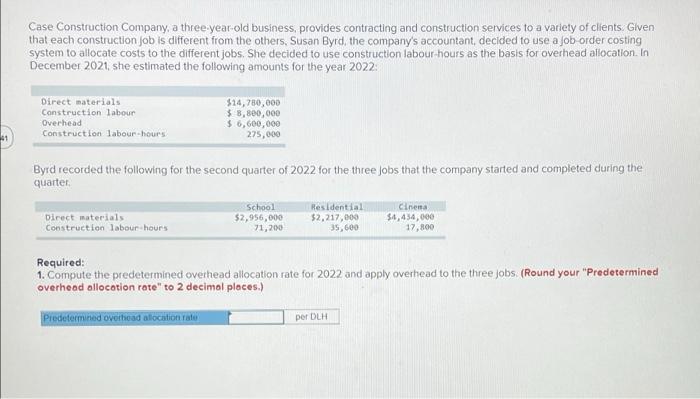

Case Construction Company, a three-year-old business, provides contracting and construction services to a variety of clients. Glven that each construction job is different from the others, Susan Byrd, the company's accountant, decided to use a job order costing system to allocate costs to the different jobs. She decided to use construction labour hours as the basis for overhead allocation. In December 2021, she estimated the following amounts for the year 2022: Direct materials Construction labour Overhead Construction labour-hours $14,780,000 $ 8,800,000 $ 6,600,000 275,000 61 Byrd recorded the following for the second quarter of 2022 for the three Jobs that the company started and completed during the quarter Direct materials Construction labour hours School $2,956,000 71,200 Residential $2,217,000 35,600 Cinema $4,434,000 17,800 Required: 1. Compute the predetermined overhead allocation rate for 2022 and apply overhead to the three Jobs (Round your "Predetermined overhead allocation rote" to 2 decimal places.) Predetermined overhead alocation Yako per DLH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts