Question: Coffee-Cola is considering a project for a new bottled beverage called Lots-A-Latte. The project would require new assets today costing $320,000 that would be depreciated

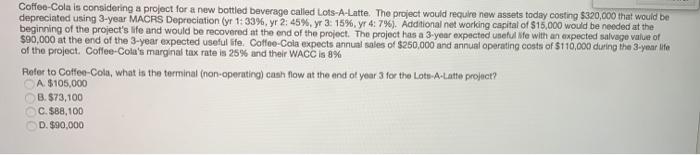

Coffee-Cola is considering a project for a new bottled beverage called Lots-A-Latte. The project would require new assets today costing $320,000 that would be depreciated using 3-year MACRS Depreciation (yr 1:33%, yr 2:45%yr 3: 15%, yr 4:7%). Additional networking capital of $15,000 would be needed at the beginning of the project's life and would be recovered at the end of the project. The project has a 3-year expected useful fe with an expected salvage value of $90,000 at the end of the 3-year expected useful life. Coffee-Cola expects annual sales of $250,000 and annual operating costs of $110,000 during the 3-year life of the project. Coffee-Cola's marginal tax rate is 25% and their WACC is 8% Roter to Coffee-Cola, what is the terminal (non-operating) cash flow at the end of year 3 for the Lots A-Latter project? A $105,000 8.573,100 C. $88,100 D. $90,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts