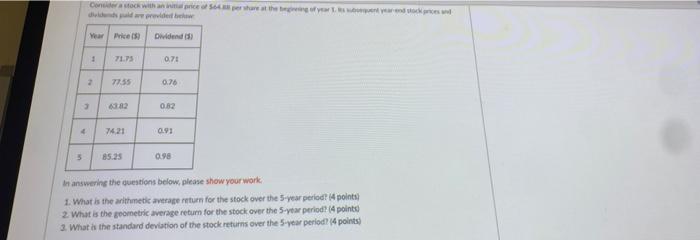

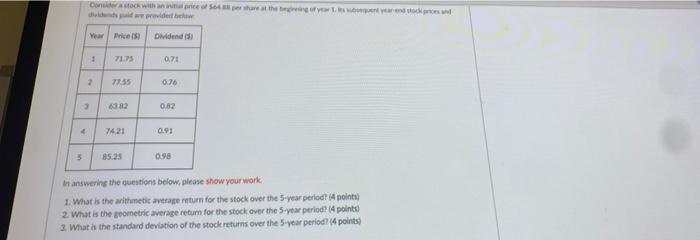

Question: Consider a stock with an initial price of $64 per share at the beginning of year 1. Its subsequent year-end stock prices and dividends paid

Consider a stock with an initial price of $64 per share at the beginning of year 1. Its subsequent year-end stock prices and dividends paid are provided below Year Price (5) Dividend (3) 1 71.75 0.71 77.55 5 85.25 0.98 In answering the questions below, please show your work. 1. What is the arithmetic average return for the stock over the 5-year period? (4 points) 2. What is the geometric average return for the stock over the 5-year period? (4 points) 3. What is the standard deviation of the stock returns over the 5-year period? (4 points) 2 3 4 6382 74,21 0.76 0.82 0.91 Consider a stock with an initial price of $64 per share at the beginning of year 1. Its subsequent year-end stock prices and dividends paid are provided below Year Price (5) Dividend (3) 1 71.75 0.71 77.55 5 85.25 0.98 In answering the questions below, please show your work. 1. What is the arithmetic average return for the stock over the 5-year period? (4 points) 2. What is the geometric average return for the stock over the 5-year period? (4 points) 3. What is the standard deviation of the stock returns over the 5-year period? (4 points) 2 3 4 6382 74,21 0.76 0.82 0.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts