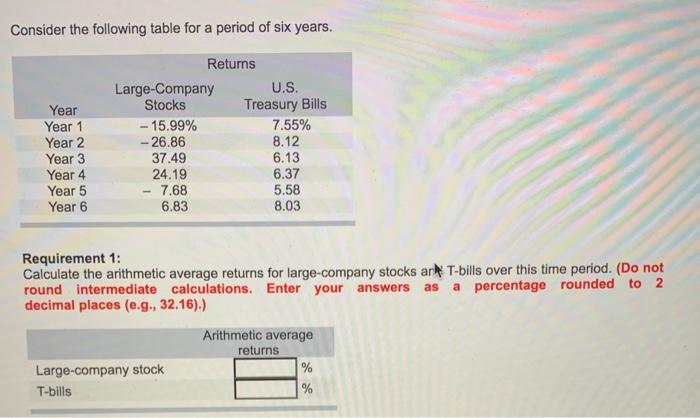

Question: Consider the following table for a period of six years. U.S. Stocks Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

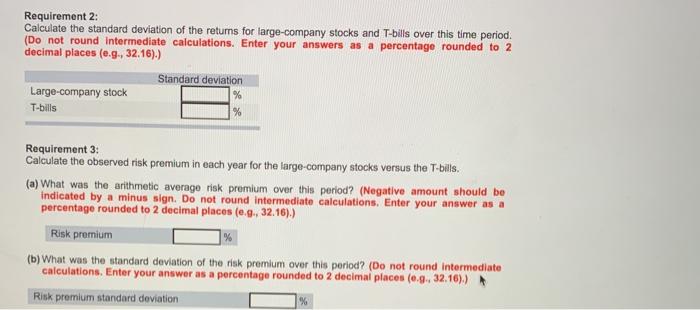

Consider the following table for a period of six years. U.S. Stocks Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Returns Large-Company Treasury Bills - 15.99% 7.55% - 26.86 8.12 37.49 6.13 24.19 6.37 7.68 5.58 6.83 8.03 Requirement 1: Calculate the arithmetic average returns for large-company stocks ar T-bills over this time period. (Do not round intermediate calculations. Enter your answers a percentage rounded to 2 decimal places (e.g., 32.16).) as Large-company stock T-bills Arithmetic average returns % % Requirement 2: Calculate the standard deviation of the returns for large-company stocks and T-bills over this time period. (Do not round Intermediate calculations. Enter your answers as a percentage rounded to 2 decimal places (e.g. 32.16).) Standard deviation % Large-company stock T-bills % Requirement 3: Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. (a) What was the arithmetic average risk premium over this period? (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (0.9. 32.16).) Risk premium (b) What was the standard deviation of the risk premium over this period? (Do not round Intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (0.9.. 32.16).) Risk premium standard deviation %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts