Question: Digital Conversions is a performance and affiliate marketing company in the Middle East. The company engages advertisers from all over the world and connect with

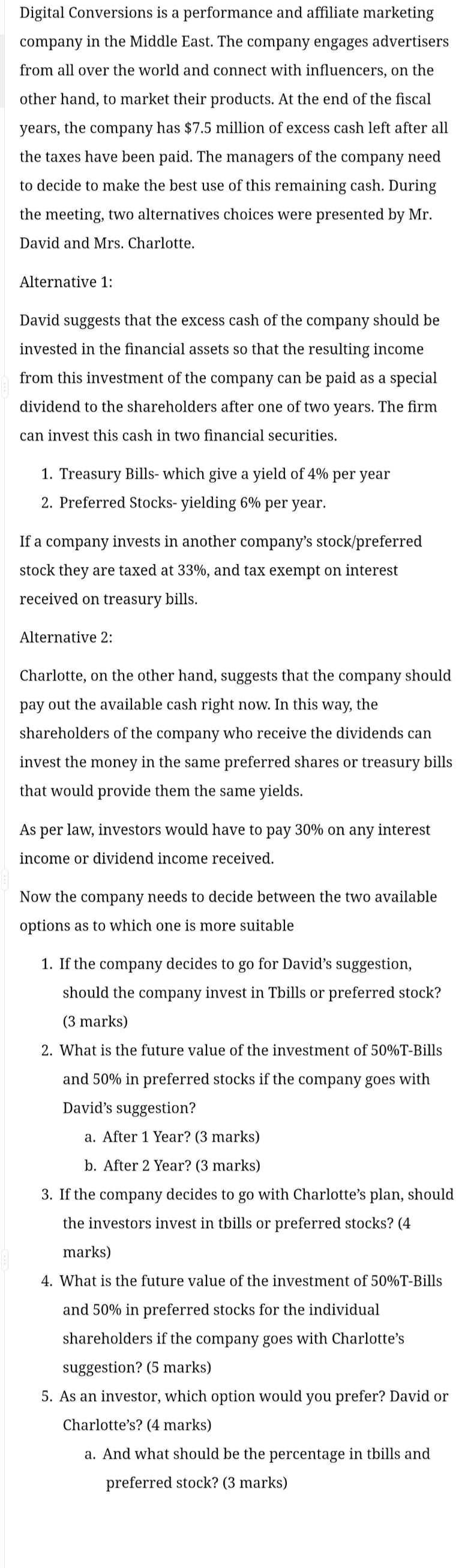

Digital Conversions is a performance and affiliate marketing company in the Middle East. The company engages advertisers from all over the world and connect with influencers, on the other hand, to market their products. At the end of the fiscal years, the company has $7.5 million of excess cash left after all the taxes have been paid. The managers of the company need to decide to make the best use of this remaining cash. During the meeting, two alternatives choices were presented by Mr. David and Mrs. Charlotte. Alternative 1: David suggests that the excess cash of the company should be invested in the financial assets so that the resulting income from this investment of the company can be paid as a special dividend to the shareholders after one of two years. The firm can invest this cash in two financial securities. 1. Treasury Bills- which give a yield of 4% per year 2. Preferred Stocks- yielding 6% per year. If a company invests in another company's stock/preferred stock they are taxed at 33%, and tax exempt on interest received on treasury bills. Alternative 2: Charlotte, on the other hand, suggests that the company should pay out the available cash right now. In this way, the shareholders of the company who receive the dividends can invest the money in the same preferred shares or treasury bills that would provide them the same yields. As per law, investors would have to pay 30% on any interest income or dividend income received. Now the company needs to decide between the two available options as to which one is more suitable 1. If the company decides to go for David's suggestion, should the company invest in Tbills or preferred stock? (3 marks) 2. What is the future value of the investment of 50%T-Bills and 50% in preferred stocks if the company goes with David's suggestion? a. After 1 Year? (3 marks) b. After 2 Year? (3 marks) 3. If the company decides to go with Charlotte's plan, should the investors invest in tbills or preferred stocks? (4 marks) 4. What is the future value of the investment of 50%T-Bills and 50% in preferred stocks for the individual shareholders if the company goes with Charlotte's suggestion? (5 marks) 5. As an investor, which option would you prefer? David or Charlotte's? (4 marks) a. And what should be the percentage in tbills and preferred stock? (3 marks) Digital Conversions is a performance and affiliate marketing company in the Middle East. The company engages advertisers from all over the world and connect with influencers, on the other hand, to market their products. At the end of the fiscal years, the company has $7.5 million of excess cash left after all the taxes have been paid. The managers of the company need to decide to make the best use of this remaining cash. During the meeting, two alternatives choices were presented by Mr. David and Mrs. Charlotte. Alternative 1: David suggests that the excess cash of the company should be invested in the financial assets so that the resulting income from this investment of the company can be paid as a special dividend to the shareholders after one of two years. The firm can invest this cash in two financial securities. 1. Treasury Bills- which give a yield of 4% per year 2. Preferred Stocks- yielding 6% per year. If a company invests in another company's stock/preferred stock they are taxed at 33%, and tax exempt on interest received on treasury bills. Alternative 2: Charlotte, on the other hand, suggests that the company should pay out the available cash right now. In this way, the shareholders of the company who receive the dividends can invest the money in the same preferred shares or treasury bills that would provide them the same yields. As per law, investors would have to pay 30% on any interest income or dividend income received. Now the company needs to decide between the two available options as to which one is more suitable 1. If the company decides to go for David's suggestion, should the company invest in Tbills or preferred stock? (3 marks) 2. What is the future value of the investment of 50%T-Bills and 50% in preferred stocks if the company goes with David's suggestion? a. After 1 Year? (3 marks) b. After 2 Year? (3 marks) 3. If the company decides to go with Charlotte's plan, should the investors invest in tbills or preferred stocks? (4 marks) 4. What is the future value of the investment of 50%T-Bills and 50% in preferred stocks for the individual shareholders if the company goes with Charlotte's suggestion? (5 marks) 5. As an investor, which option would you prefer? David or Charlotte's? (4 marks) a. And what should be the percentage in tbills and preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts