Question: Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct

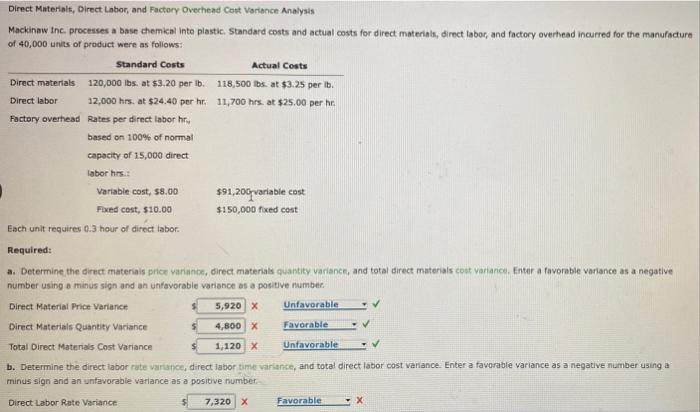

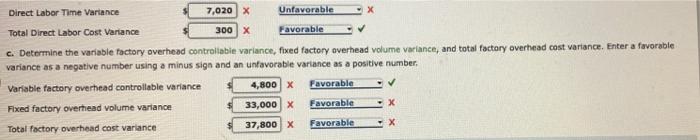

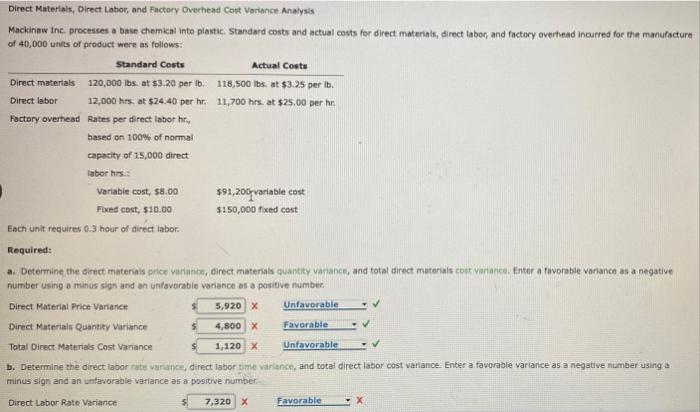

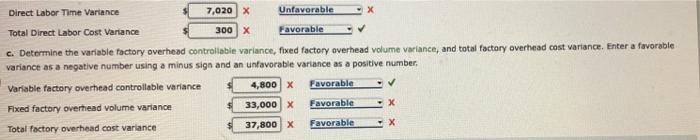

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Standard Costs Actual Costs Direct materials Direct labor 120,000 lbs. at $3.20 per lb. 12,000 hrs. at $24.40 per hr. 118,500 lbs. at $3.25 per lb. 11,700 hrs. at $25.00 per hr. Factory overhead Rates per direct labor hr based on 100% of normal capacity of 15,000 direct labor hrs.: Variable cost, $8.00 $91,200 variable cost Fixed cost, $10.00 $150,000 fixed cost Each unit requires 0.3 hour of direct labor. Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Material Price Variance 5,920 X Unfavorable Favorable Direct Materials Quantity Variance 4,800 X Total Direct Materials Cost Variance 1,120 X Unfavorable b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Direct Labor Rate Variance 7,320 X Favorable X Direct Labor Time Variance 7,020 X Unfavorable X Total Direct Labor Cost Variance 300 X Favorable c. Determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Variable factory overhead controllable variance 4,800 x Favorable - V Fixed factory overhead volume variance 33,000 X Favorable -x Total factory overhead cost variance 37,800 X Favorable -X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts