Question: Exercise 10-7A (Static) Recording product versus SG&A costs in a financial statements model LO 10-3 Weib Manufacturing experienced the following events during its first accounting

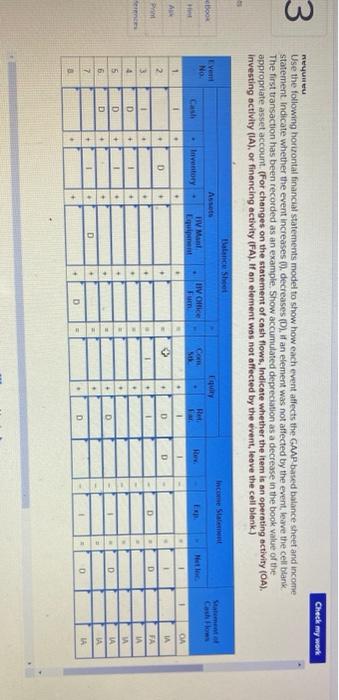

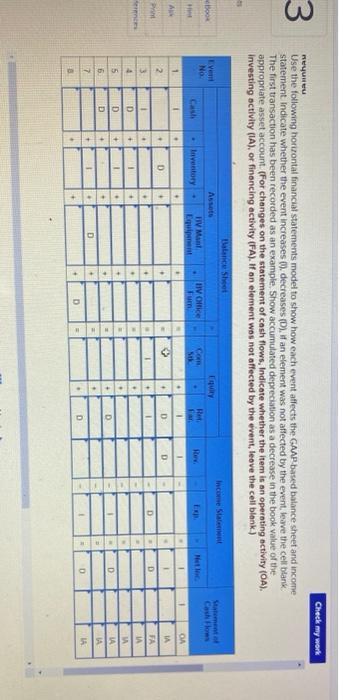

Exercise 10-7A (Static) Recording product versus SG&A costs in a financial statements model LO 10-3 Weib Manufacturing experienced the following events during its first accounting period OOK 1. Recognized revenue from cash sale of products. 2. Recognized cost of goods sold from sale referenced in Event 1. 3. Acquired cash by issuing common stock 4. Paid cash to purchase raw materials that were used to make products 5. Paid wages to production workers 6. Paid salaries to administrative staff 7. Recognized depreciation on manufacturing equipment 8. Recognized depreciation on office furniture. ce Required Use the following horizontal financial statements model to show how each event affects the GAAP-based balance sheet and income statement. Indicate whether the event increases (1). decreases (D), if an element was not affected by the event, leave the cell blank The first transaction has been recorded as an example. Show accumulated eciation as a decrease in the book value of the appropriate asset account. (For changes on the statement of cash flows, Indicate whether the item is an operating activity (OA). investing activity (IA), or financing activity (FA). If an element was not offected by the event, leave the cell blank.) Balance Sheet Income Statement Check my work 3 Use the following horizontal financial statements model to show how each event affects the GAAP based balance sheet and income statement indicate whether the event increases (). decreases (D). If an element was not affected by the event, leave the cell blank The first transaction has been recorded as an example. Show accumulated depreciation as a decrease in the book value of the appropriate asset account. (For changes on the statement of cash flows, Indicate whether the item is an operating activity (OA). Investing activity (IA), or financing activity (FA). If on element was not affected by the event, leave the cell blank) Iata Sheet Income State Door Evem NO Statement Cashflom Cash HIV Mint Equipe HIV Office Furni Com Het vectory . 1 1 . OA 1 . 1 1 AL 1 . + . D D IA D 2 3 . . + --- D D 1 1 + . D + 1 . 5 D D ---- + D D . IA IA 6 + 7 . + D 1 D + . D - +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts