Question: In the U.S., the new audit reporting standard (effective since June 30,2019) requires auditors to disclose the financial statement matters that required especially challenging, subjective,

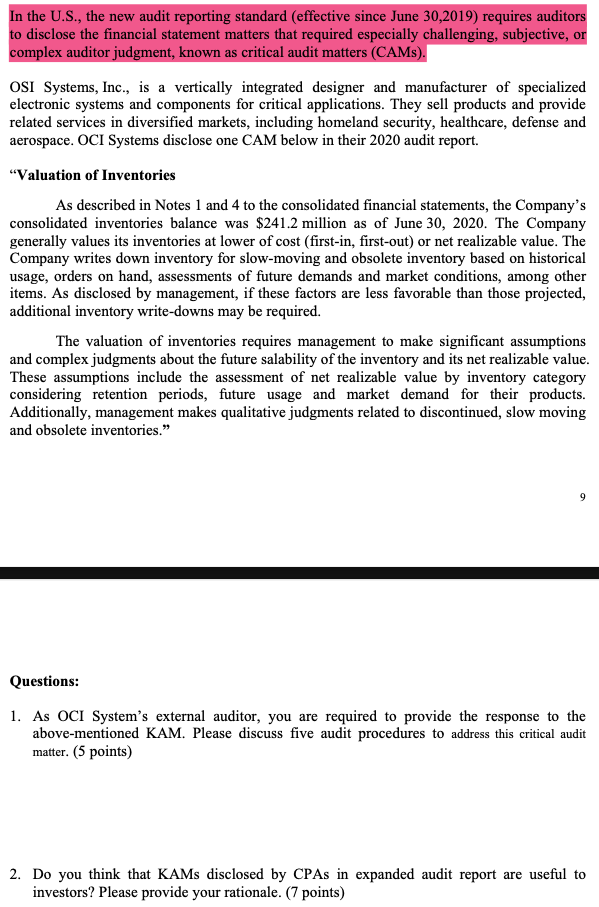

In the U.S., the new audit reporting standard (effective since June 30,2019) requires auditors to disclose the financial statement matters that required especially challenging, subjective, or complex auditor judgment, known as critical audit matters (CAM). OSI Systems, Inc., is a vertically integrated designer and manufacturer of specialized electronic systems and components for critical applications. They sell products and provide related services in diversified markets, including homeland security, healthcare, defense and aerospace. OCI Systems disclose one CAM below in their 2020 audit report. "Valuation of Inventories As described in Notes 1 and 4 to the consolidated financial statements, the Company's consolidated inventories balance was $241.2 million as of June 30, 2020. The Company generally values its inventories at lower of cost (first-in, first-out) or net realizable value. The Company writes down inventory for slow-moving and obsolete inventory based on historical usage, orders on hand, assessments of future demands and market conditions, among other items. As disclosed by management, if these factors are less favorable than those projected, additional inventory write-downs may be required. The valuation of inventories requires management to make significant assumptions and complex judgments about the future salability of the inventory and its net realizable value. These assumptions include the assessment of net realizable value by inventory category considering retention periods, future usage and market demand for their products. Additionally, management makes qualitative judgments related to discontinued, slow moving and obsolete inventories." 9 Questions: 1. As OCI System's external auditor, you are required to provide the response to the above-mentioned KAM. Please discuss five audit procedures to address this critical audit matter. (5 points) 2. Do you think that KAMs disclosed by CPAs in expanded audit report are useful to investors? Please provide your rationale. (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts