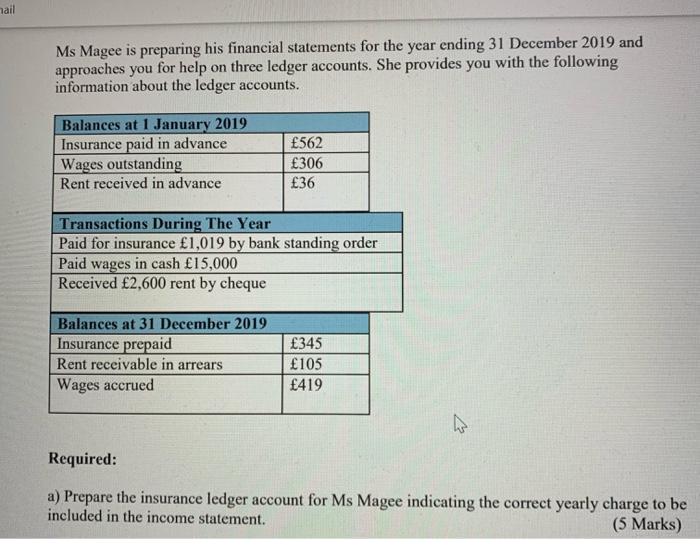

Question: nail Ms Magee is preparing his financial statements for the year ending 31 December 2019 and approaches you for help on three ledger accounts. She

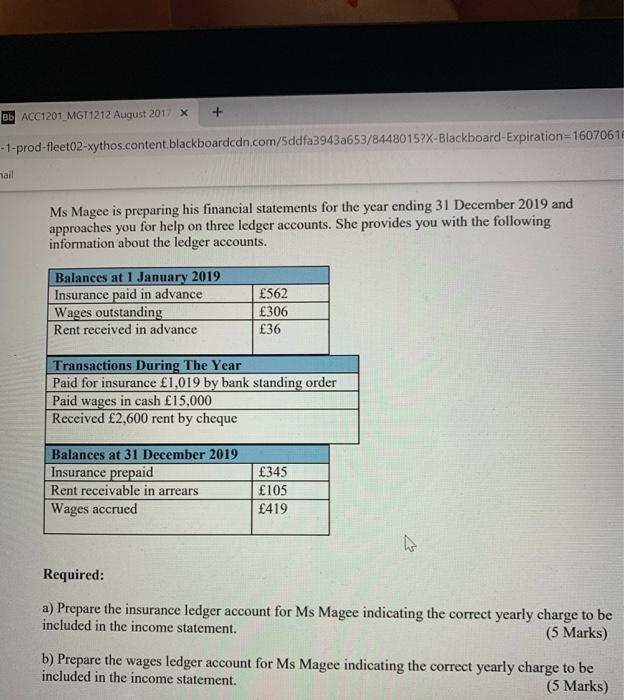

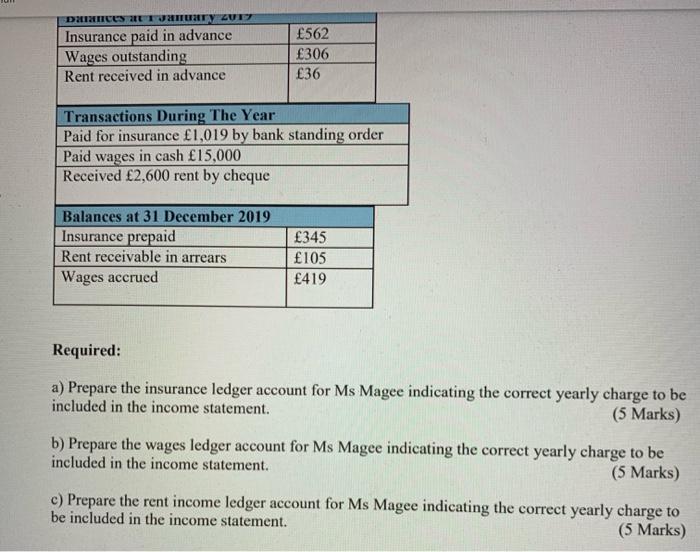

nail Ms Magee is preparing his financial statements for the year ending 31 December 2019 and approaches you for help on three ledger accounts. She provides you with the following information about the ledger accounts. Balances at 1 January 2019 Insurance paid in advance Wages outstanding Rent received in advance 562 306 36 Transactions During The Year Paid for insurance 1,019 by bank standing order Paid wages in cash 15,000 Received 2,600 rent by cheque Balances at 31 December 2019 Insurance prepaid Rent receivable in arrears Wages accrued 345 105 419 Required: a) Prepare the insurance ledger account for Ms Magee indicating the correct yearly charge to be included in the income statement. (5 Marks) BE ACC1201 MGT1212 August 2017 X - 1-prod-fleet02-xythos.content.blackboardcdn.com/5ddfa3943a653/84480157X-Blackboard - Expiration=1607061 mail Ms Magee is preparing his financial statements for the year ending 31 December 2019 and approaches you for help on three ledger accounts. She provides you with the following information about the ledger accounts. Balances at 1 January 2019 Insurance paid in advance Wages outstanding Rent received in advance 562 306 36 Transactions During The Year Paid for insurance 1,019 by bank standing order Paid wages in cash 15,000 Received 2,600 rent by cheque Balances at 31 December 2019 Insurance prepaid Rent receivable in arrears Wages accrued 345 105 419 Required: a) Prepare the insurance ledger account for Ms Magee indicating the correct yearly charge to be included in the income statement. (5 Marks) b) Prepare the wages ledger account for Ms Magee indicating the correct yearly charge to be included in the income statement. (5 Marks) DURCUS TURTY ZE Insurance paid in advance Wages outstanding Rent received in advance 562 306 36 Transactions During The Year Paid for insurance 1,019 by bank standing order Paid wages in cash 15,000 Received 2,600 rent by cheque Balances at 31 December 2019 Insurance prepaid Rent receivable in arrears Wages accrued 345 105 419 Required: a) Prepare the insurance ledger account for Ms Magee indicating the correct yearly charge to be included in the income statement. (5 Marks) b) Prepare the wages ledger account for Ms Magee indicating the correct yearly charge to be included in the income statement. (5 Marks) c) Prepare the rent income ledger account for Ms Magee indicating the correct yearly charge to be included in the income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts